Nov 8, 2019

Bitcoin’s Break Below $9,000 Risks Erasing Xi-Inspired Rally

, Bloomberg News

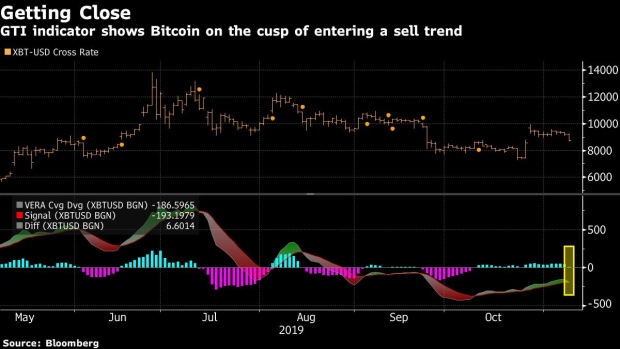

(Bloomberg) -- Bitcoin’s push back below $9,000 has a key technical indicator suggesting the cryptocurrency risks entering a selling trend.

The GTI Vera Convergence Divergence Indicator shows a narrowing gap between the signal and vera lines, which suggests a trend change may be on the horizon. If this occurs, the largest digital currency could retest the lows seen before its rampant run following comments by China’s President Xi Jinping in October.

Bitcoin rallied after Xi said that China plans to increase investment to “keep our country at the very forefront” of blockchain technology in the search for industrial advantages. Traders said speculators took those comments as a positive for the underlying technology that runs Bitcoin.

The cryptocurrency still faces resistance at the $10,000 level, with investors uncertain about what catalyst could help break that barrier.

“It’s had a decent move to the downside today, but to me, it’s going to remain range-bound for a while,” said JJ Kinahan, chief market strategist at TD Ameritrade. “I don’t know what the stimulus would be to take us outside of that range. It’s similar, to me, to what we see in the market overall.”

Bitcoin fell as much as 5.8% to $8,679 on Friday in New York trading, according to Bloomberg consolidated pricing. Other tokens such as Ether, Litcoin and XPR also slumped.

--With assistance from Kenneth Sexton (Global Data).

To contact the reporters on this story: Claire Ballentine in New York at cballentine@bloomberg.net;Vildana Hajric in New York at vhajric1@bloomberg.net

To contact the editors responsible for this story: Jeremy Herron at jherron8@bloomberg.net, Dave Liedtka, Rita Nazareth

©2019 Bloomberg L.P.