Oct 22, 2022

Bitcoin’s Changing Correlations May Mean It’s Becoming a Haven Again, BofA Says

, Bloomberg News

(Bloomberg) -- Bitcoin’s movements in relation to other assets may indicate that investors see it becoming a haven again, after a stretch where it’s traded basically as a risk asset, according to Bank of America Corp.

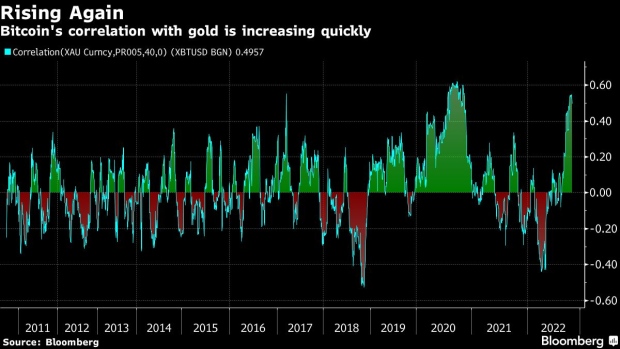

The largest cryptocurrency has a 40-day correlation with gold of about 0.50, up from around zero in mid-August. While the correlations are higher with the S&P 500, at 0.69, and Nasdaq 100 at 0.72, they’ve flattened out and are below record levels from a few months ago. BofA digital strategists Alkesh Shah and Andrew Moss see that as a sign that things could be changing.

“A decelerating positive correlation with SPX/QQQ and a rapidly rising correlation with XAU indicate that investors may view Bitcoin as a relative safe haven as macro uncertainty continues and a market bottom remains to be seen,” the strategists wrote.

Bitcoin has traded in near lockstep with risk assets in the past couple of years, as pandemic-era stimulus flooded the global economy, and then as central banks like the Federal Reserve hiked rates to combat worsening inflation. That’s contradicted one of the main investment narratives put forward by crypto believers, which is that the asset with a fixed supply could serve as “digital gold,” a safe haven free from the influence of decisions by central banks and governments.

The BofA note dovetails with recent comments from the likes of Mike Novogratz, who said on Thursday that he sees Bitcoin as “the canary in the coal mine” alongside gold and expects it to rally before other tokens, as well as Lauren Goodwin from New York Life Investments, who has said that Bitcoin and gold could both be perceived as a central-bank hedge.

©2022 Bloomberg L.P.