Jan 20, 2022

Bitcoin’s Correlation With Tech Strengthens as Risk Appetite Returns

, Bloomberg News

(Bloomberg) -- Bitcoin is proving once again that its long-touted classification as an uncorrelated asset is more folklore than fact.

The largest cryptocurrency by market value was earlier on pace for its biggest gain this year amid a broad rebound across markets as the global sovereign-bond selloff paused and investors focused on U.S. corporate earnings to assess the economic recovery.

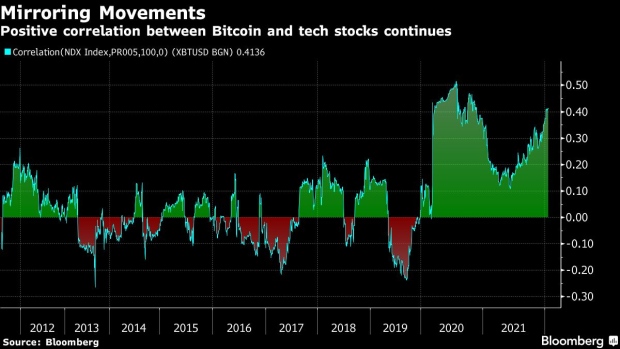

The 100-day correlation coefficient of the coin and the Nasdaq 100 Index rose above 0.40, among the highest such readings going back to 2011. A coefficient of 1 means the assets are moving in lockstep, while minus-1 would show they’re moving in opposite directions.

“It’s risk on -- that may be the simple explanation,” said Ben Emons, managing director of macro strategy at Medley Global Advisors. “That is a correlation that may be worth highlighting. Sometimes it is just a simple story.”

Bitcoin rose as much as 4.3% to $43,506 during New York trading hours. The Bloomberg Galaxy Crypto Index also climbed by a similar amount. Popular DeFi tokens including Uniswap and Compound gained.

The upswing is happening against a backdrop of news out of Russia that the nation’s central bank is proposing a ban on Bitcoin mining and crypto trading activity.

Still, some observers said the crackdown may have little effect on the market and that Bitcoin’s reputation as an uncorrelated asset may be playing out in other ways.

Diana Biggs, chief strategy officer of Canadian-listed digital asset brokerage DeFi Technologies, said to expect more government threats to restrict crypto-related activities.

“As we’ve seen in the past, the effect is negligible and that’s by design. Bitcoin was designed to be an inherently global and censorship-resistant,” Biggs said. “It exists outside of the construct of nation states and personally I think it’s one of the most interesting aspects.”

©2022 Bloomberg L.P.