Dec 5, 2022

Bitcoin’s Status Quo Is Making Some Long-Time Observers Nervous

, Bloomberg News

(Bloomberg) -- Cryptocurrencies are maintaining the status quo in the wake of the most recent market downturn and that is being viewed by some long-time observers as an ominous sign.

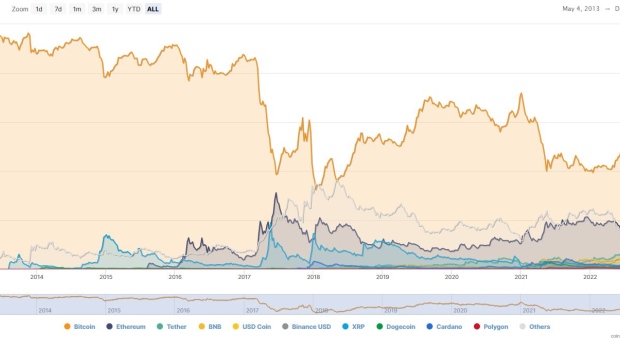

Bitcoin’s dominance in the market, currently below 40%, hasn’t wavered much amid the turmoil surrounding the implosion of Sam Bankman-Fried’s FTX exchange. In past boom and bust cycles, that percentage of market share tended to increase as investors gravitated to the original virtual currency given its stature as being the “safest” in a crowd of volatile investments.

The idea is that the coin is the most liquid within the sector, and has the lowest volatility of the non-stablecoin large-cap tokens, said Noelle Acheson, author of the “Crypto Is Macro Now” newsletter. During the May-June stretch, for example, when a number of projects and companies folded amid market turmoil, Bitcoin’s dominance rose to around 48%, and then diminished again once risk appetite returned. But during the November tumble, that didn’t happen.

“In times of intense uncertainty and market turmoil, you normally see a rotation into the relative ‘safety’ of BTC,” Acheson said. “Part of it is that the FTX drama was for many traders and investors the final nail in the coffin and they didn’t rotate into BTC -- they just left the market,” she said, adding that she’s still seeing speculation happening in some smaller coins.

While just one statistic, it points to the severity of the recent plunge in cryptocurrencies that’s happened in the wake of FTX’s bankruptcy. The exchange had once been viewed as a premium platform in the nascent space and its downfall took many by surprise, undermining confidence in the market and destroying numerous reputations as well.

Crypto prices have plunged, with Bitcoin hovering around $17,000, down from near $69,000 just a little more than a year ago. Other tokens have fared far worse. And in the meantime, liquidity has dried up as Alameda Research, a hedge fund also founded by Bankman-Fried, also folded.

To many market-participants, this crash feels different, partly because FTX and its subsidiaries had been so highly regarded. Some predict that it could take years for the sector to recover and that, in the meantime, institutional investors could stay away for good.

“People are feeling there’s several other shoes to drop in terms of companies. It’s just got everybody sitting on the sidelines,” said Matt Maley, chief market strategist at Miller Tabak + Co. He points to Ether, which has held up better than Bitcoin has since the Nov. 22 lows. “Ethereum has many more uses with the blockchain technology, whereas Bitcoin is basically just a cryptocurrency.”

On Twitter, where a lot of crypto discourse happens, there’s still plenty of shameless shilling happening, but to a lesser extent than before. There’s more caution, and there’s definitely a lot of fear. The Crypto Fear and Greed Index has been in “fear” territory for weeks.

Many infamous crypto promoters, in the meantime, have removed the once-ubiquitous laser eyes that denote a spiritual alignment with the space and its virtues. Perhaps the idea is that the future’s not looking so blindingly bright anymore -- at least for now.

In the past, when speculation was running rampant and token prices were rallying, Bitcoin’s dominance had tended to wane, and during such periods, alternative coins -- or alt-coins -- have benefited, with weird projects and offshoots gaining notoriety.

“If you’re bearish on the market, BTC is not proving to be defensive, and if you’re bullish on the market, BTC no longer represents any of the positive blockchain initiatives,” including stablecoins, DeFi, Web 3 and NFTs, among other things, said Jeff Dorman, chief investment officer at Arca. “It’s hard to justify owning BTC for any reason other than a true out-of-the-money call option on a collapse of the banking and fiat system, whereas other digital assets represent bets on the growth of the technology and its various use cases.”

©2022 Bloomberg L.P.