Jul 13, 2022

Bitcoin Settles in Calm Before Possible US Inflation Storm

, Bloomberg News

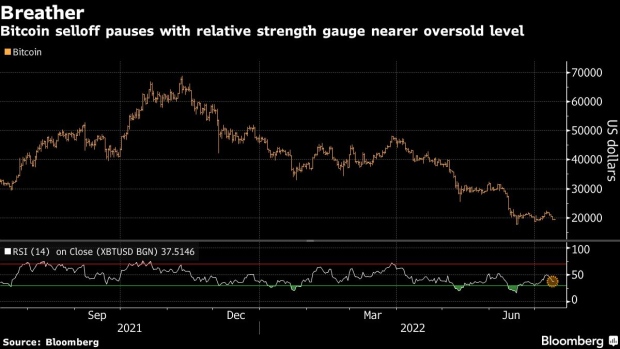

(Bloomberg) -- Bitcoin settled into a holding pattern on Wednesday ahead of US inflation figures that could inject fresh volatility.

The largest cryptocurrency held at about $19,500 in Asian trading, little changed on the day but nursing a drop of 11% since the end of last week. Global markets were also becalmed as investors took a deep collective breath in the countdown to the inflation data.

A print that tops expectations of 8.8% could harden bets on Federal Reserve monetary tightening, roiling speculative investments like cryptocurrencies anew. But a weaker reading has the potential to enliven the market mood.

Headline inflation below 8.5% could lead to a scenario where the dollar “drops universally” and “crypto goes up 5%+,” Chris Weston, head of research at Pepperstone Group, wrote in a note.

Fed rate hikes, the Terra ecosystem meltdown and the collapse of crypto hedge fund Three Arrows Capital have all contributed to a 58% drop in Bitcoin in 2022.

Total crypto market value was at about $906 billion on Wednesday, according to CoinGecko, down from more than $3 trillion in November.

Technical analyst Katie Stockton, co-founder of Fairlead Strategies, earlier this week said “from a long-term perspective, downside momentum is growing” and that Bitcoin could test the $18,300 to $19,500 price range.

©2022 Bloomberg L.P.