Mar 19, 2020

Bitcoin Shows Some Signs of Stabilization After Brutal Decline

, Bloomberg News

(Bloomberg) -- Here’s some good news for cryptocurrency fans: Bitcoin is showing signs of stabilizing after suffering a severe decline amid the wider coronavirus-induced meltdown.

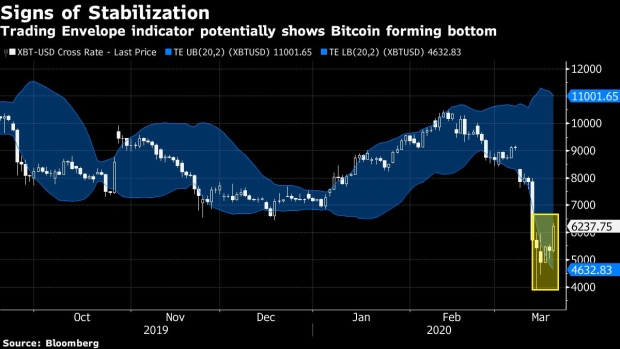

Based on the last four trading days, the largest digital token has bounced from session lows to gradually mark higher-lows, a signal it may be forming a bottom after the almost 30% decline this month.

In addition, the coin closed stronger than where it started Wednesday, allowing it to overtake the lower limit of its Trading Envelope, an indicator that smooths moving averages to map out higher and lower limits. That could be seen as a positive sign for Bitcoin. Now that the coin has retaken its lower limit, a reversion to the mean price level is in play.

On Thursday, Bitcoin rose 16.8% to around $6,237 as of 2:12 p.m. in New York, while Bitcoin Cash gained more than 20%. Litecoin and XRP were both up more than 10%.

Cryptocurrency prices slumped this month amid the mad dash away from riskier assets as the coronavirus shuttered businesses and borders across the globe. With the outbreak spreading to more than 200,000 worldwide, stock gauges globally plunge into bear markets. Bitcoin has lost near 30% so far this month.

“The crypto market attempted to decouple from the S&P 500 correlation trade that has been at the forefront of recent market activity and after days of trading in the red,” said Denis Vinokourov, head of research at Bequant, a London-based digital asset firm. “While Bitcoin may have been trading in lockstep with other risk assets, namely equities, the odds of this correlation breaking down were always high.”

Amid the sell-off, investors have rushed to offload everything from stocks to bonds in a bolt for cash. To Danny Masters of CoinShares, that creates a great environment for cryptocurrencies.

“Bitcoin is arguably the only financial asset that can operate remotely -- nobody needs to go to work to make Bitcoin work. Nobody needs to fill an ATM machine,” said the chairman of CoinShares, an asset management firm. “While things look bleak for everything, I can’t think of a better asset to buy than Bitcoin.”

©2020 Bloomberg L.P.