Jan 18, 2021

Bitcoin steady as analysts say getting back to US$40k is key

, Bloomberg News

Feds not adding to Bitcoin to reserves; Canadian banks stay mum

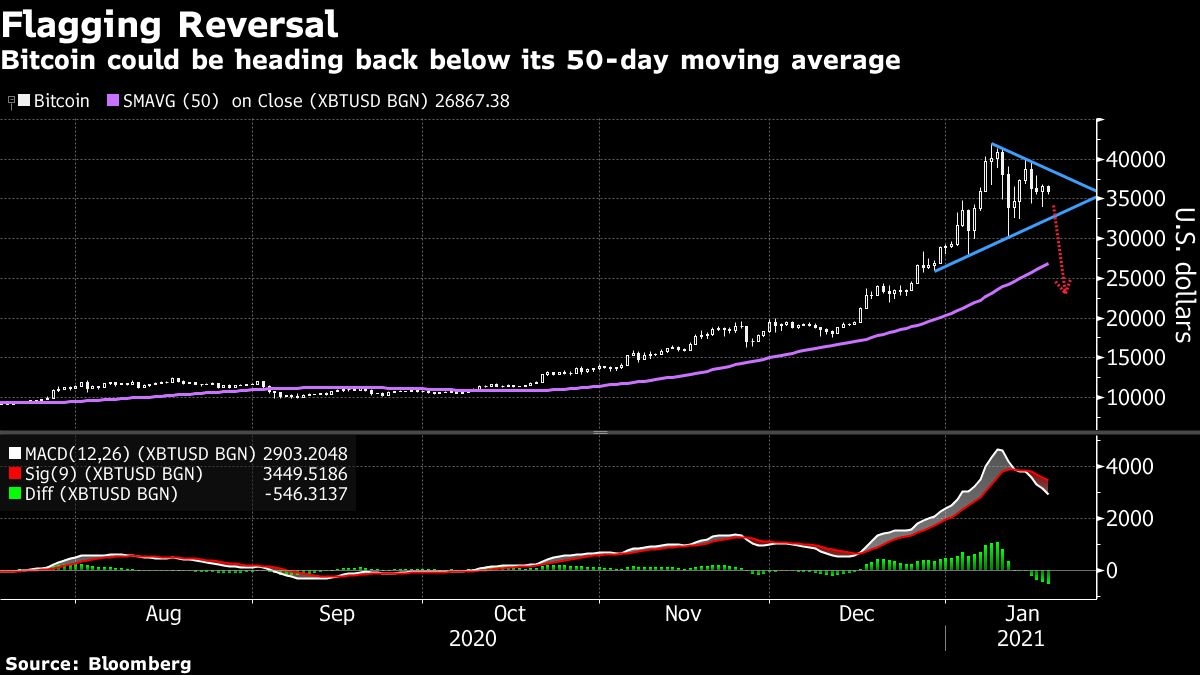

Bitcoin hovered near US$36,000 on Monday, below a level that strategists at JPMorgan Chase & Co. see as an inflection point for the digital coin.

The cryptocurrency could be hurt by an exodus of trend-following investors unless it can “break out” above US$40,000 soon, a team including Nikolaos Panigirtzoglou said. The pattern of demand for Bitcoin futures and the US$22.9 billion Grayscale Bitcoin Trust will help determine the outlook, they added.

“The flow into the Grayscale Bitcoin Trust would likely need to sustain its US$100 million per day pace over the coming days and weeks for such a breakout to occur,” the strategists wrote in a note on Friday.

Traders seeking clues about investor appetite for risk have been gripped by Bitcoin’s stunning rally and turbulent 10 per cent slide from a record of almost US$42,000 on Jan. 8. The cryptocurrency boom since March has reflected the ebullience of financial markets awash in stimulus -- as well as concern over whether gains will ultimately prove fleeting.

The JPMorgan strategists said Bitcoin was in a similar position in late November, except with US$20,000 as the test. Flows of institutional investment into the Grayscale trust helped the world’s largest cryptocurrency extend its rally, they wrote.

Trend-following traders “could propagate the past week’s correction” and “momentum signals will naturally decay from here up till the end of March” if Bitcoin’s price fails to break above US$40,000, they said.

Bitcoin fell 2.1 per cent to US$35,782 as of 2:07 p.m. in London on Monday.

Exactly what’s driven the yearlong near-quadrupling in Bitcoin’s price remains murky. Commentators have cited day traders, wealthy buyers, hedge funds, companies and even signs of interest from long-term investors like insurers.

‘Dread to Think’

Some, like Chris Iggo, remain skeptical of Bitcoin’s appeal to large institutions.

“I dread to think what most risk officers would think about that being in a core investment portfolio,” the chief investment officer of core investments at Axa Investment Managers wrote in a note. “For assets to be considered in a long-term investment portfolio one should be able to attach some fundamental intrinsic value to them.”

Bitcoin’s proponents argue it’s maturing as a hedge for dollar weakness and the possibility of faster inflation in a recovering global economy. Others say its defining characteristic remains speculative booms followed by busts.