Jun 29, 2022

Bitcoin Struggles Just Above $20,000 as ‘Final Washout’ Possible

, Bloomberg News

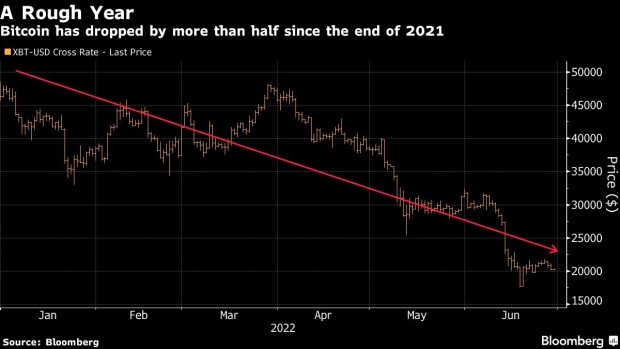

(Bloomberg) -- Bitcoin stayed just above $20,000 on Wednesday, with its inability to gain upward traction fueling concern among analysts of further declines.

The largest cryptocurrency was little changed, bound in a range between about $20,130 and $20,429. The MVIS CryptoCompare Digital Assets 100 index, which measures 100 of the top tokens, fell 2.1% as of 1:30 p.m. in Singapore.

“Most short-term technicals point to an above-average chance of a final ‘washout’-style decline before this bottoms,” said Mark Newton, technical strategist at Fundstrat, in a note Tuesday. “The initial warning should occur on a daily close under $20,491, while under $19,744 allows for a pullback to retest $17,592. Technically not much lies under $17,592 before $12,500 to $13,000, which I expect should be an excellent place for intermediate-term buyers to add to longs.”

Bitcoin has been sinking along with riskier assets in recent months, so a slide on a day of tech-stock declines is par for the course. Crypto markets have also been bludgeoned by the meltdown of the Terra/Luna ecosystem, trouble at hedge fund Three Arrows Capital and frozen withdrawals at places like Celsius, as well as job-cut announcements from the likes of Crypto.com, Coinbase and BlockFi.

The crypto industry must be relieved that prices have steadied out “given the stream of negative headlines over the last couple of months,” said Craig Erlam, senior market analyst at Oanda. “I fear more may follow in the weeks ahead and I wonder whether the community does too, given its inability to get any traction above $20,000.”

Still, any further dips might create a good chance to buy, Fundstrat said.

“Look to buy dips within two to three weeks at lower levels,” Newton said, “and any move down to test or briefly undercut June lows presents an opportunity.”

©2022 Bloomberg L.P.