Jan 21, 2022

Crypto selloff pushes Bitcoin to a six-month low of US$38,000

, Bloomberg News

PwC Sees a Lot of Enthusiasm in the Crypto Space

Bitcoin tumbled in an extended selloff for cryptocurrencies, falling past US$38,000 to its lowest level in six months.

The largest token sank as much as 8.7 per cent on Friday, marking a three-day downturn. More than 236,000 traders had their positions closed over the past 24 hours, with liquidations totaling US$867 million, according to data from Coinglass, a cryptocurrency futures trading and information platform.

Other cryptocurrencies were similarly in the red as investors offloaded risky bets in a volatile week for global markets. Ether fell below US$3,000, losing as much as 11 per cent, while Solana, Cardano and Binance Coin also slumped.

Bitcoin has suffered a rocky start to the year and prices are down more than 40 per cent from the early November peak. Digital assets suffered especially in recent days against a wider tech selloff, rising regulatory threats and concerns around tightening U.S. monetary policy.

Regulators in the U.K., Spain and Singapore this week suggested toughening the rules on crypto-asset promotion to inexperienced investors, while the Russian central bank on Thursday proposed a ban on cryptocurrencies entirely.

“Rumors of Russian mining bans, the effects of tapering programs and ongoing regulatory concerns in certain jurisdictions are currently taking more weight in trading and investment decisions than the underlying long-term fundamentals,” said Jason Deane, an analyst at digital asset research firm Quantum Economics.

“At the same time, increased use and adoption of Bitcoin in high-inflation economies creates a confusing market picture leading to lack of decisive direction and momentum either way,” he added.

Deane predicted “choppy, directionless trading” in the short term with further weakness possibly still to come.

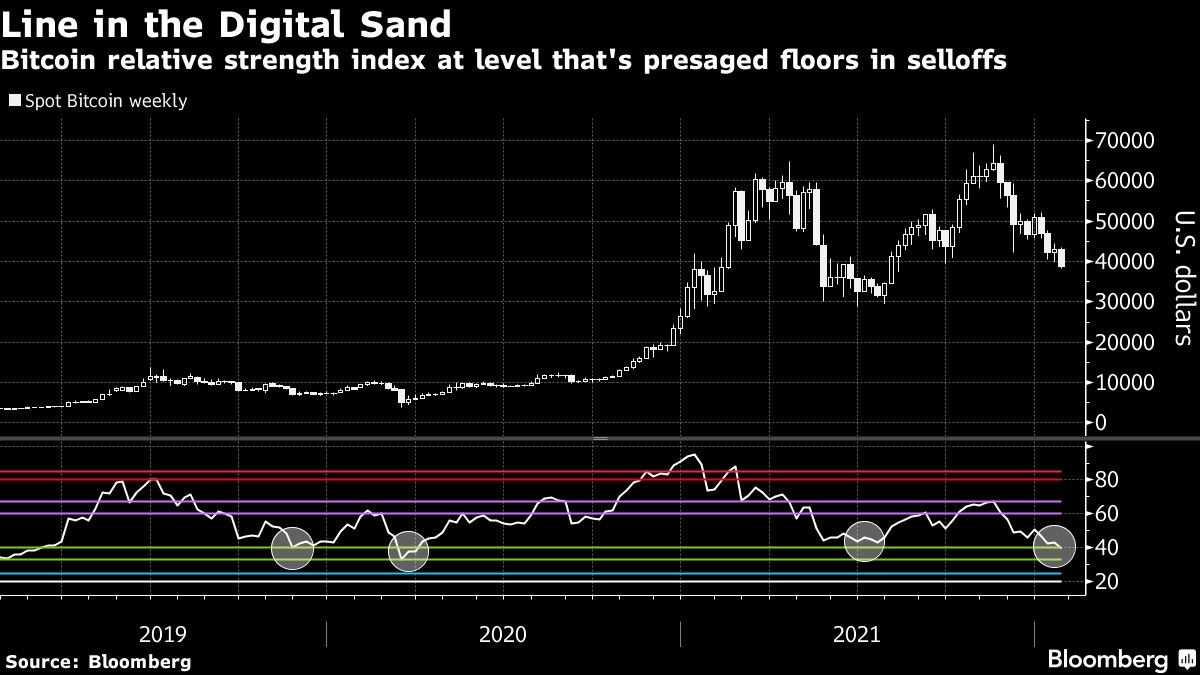

A technical pattern based on a momentum indicator known as the weekly relative strength index hinted at the possibility that Bitcoin’s slump might be due a breather. The indicator on Friday fell into a region that in the past accompanied floors in Bitcoin selloffs.

“Bitcoin and the broader crypto market remain subject to the whims of macro variables,” Fundstrat Digital Asset Research strategists Sean Farrell and Will McEvoy wrote in a note.