Oct 23, 2019

Bitcoin tumbles to 5-month low as Libra hit by U.S. backlash

, Bloomberg News

The hostility toward Facebook’s Libra cryptocurrency appears to be weighing on the sentiment for Bitcoin.

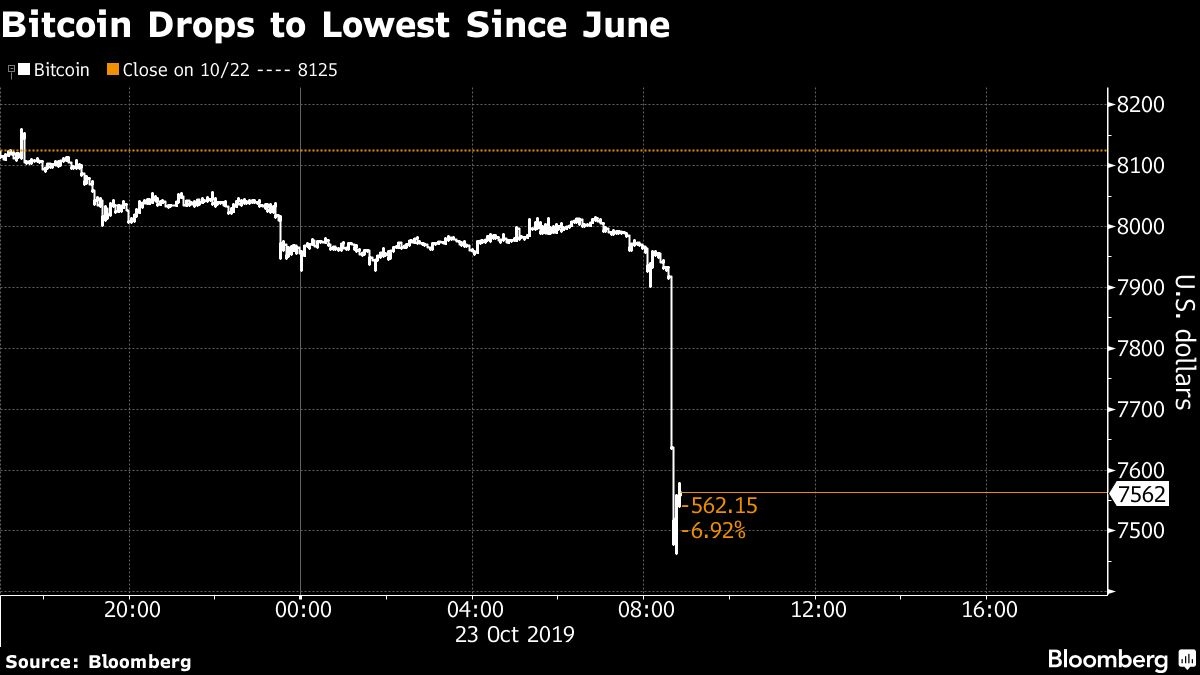

The world’s largest cryptocurrency dropped as much as 10 per cent to US$7,305 in New York, the lowest level since May. Other digital tokens such as Ether and Litecoin, which dropped 11 per cent and 13 per cent respectively, slumped even more as Facebook Chief Executive Officer Mark Zuckerberg testified before the House Financial Services Committee on Wednesday.

“The biggest thing behind this is that volumes have been very very low,” said Josh Lim, head of trading strategy at Galaxy Digital in New York. “On the sentiment side of things, the fact that the Libra coalition has faced some major challenges and the Telegram launch was halted by the SEC, it really curtailed investor appetite for crypto broadly.”

Potentially adding to concern is the news that Alphabet Inc.’s Google has built a computer that’s reached “quantum supremacy,” performing a computation in 200 seconds that would take the fastest supercomputers about 10,000 years. Skeptics of cryptocurrencies have noted that advances in computing could make the slower proof of work system used by Bitcoin and other tokens obsolete.

As often the case with cryptocurrencies, traders pointed to an array of potential catalysts beside Libra for the sudden spike down in prices around 8:30 a.m. New York time. Among the reasons cited were liquidation of futures contracts on exchanges such as BitMex, the stablecoin Tether trading at a discount to parity and a general lack of liquidity among cryptocurrencies.

“The fact that this is losing so much momentum so quickly is telling people that Bitcoin as a widely accepted currency is going to take longer than they were hoping,” said Matt Maley, equity strategist at Miller Tabak + Co.