Jun 22, 2018

Chen doesn't understand investor worries over software revenue declines

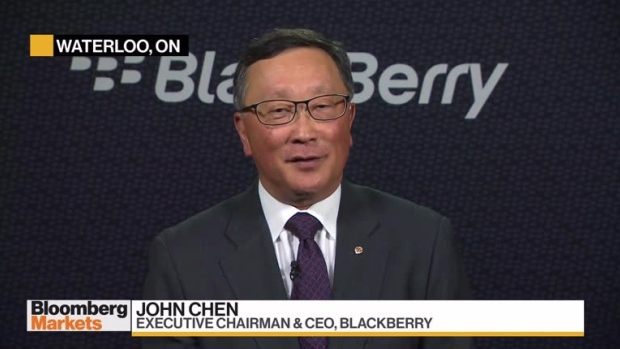

BlackBerry Ltd.’s CEO John Chen doesn’t understand why investors are so spooked by his company’s latest quarterly results.

Chen blamed BlackBerry’s 18 per cent year-over-year software revenue decline on changes to accounting standards. The report led the company’s Toronto-listed shares (BB.TO) to decline by more than nine per cent in Friday trade, falling as low as $14.01. The stock closed $1.45, or 9.29 per cent, lower at $14.16.

“I don’t understand that,” Chen told BNN Bloomberg in an interview. “Our total revenue numbers were higher than the street expected. Our auto software business – the BTS business, our QNX business – grew 31 per cent year-over-year, our licensing businesses were great, [they] grew a lot year-over-year.”

“The enterprise business had to go through new accounting rules adoption… and that lowered the number by some amount, but we’re going to recapture [it] in the future. So, I’m not exactly sure why people are reacting [negatively].”

The company has grabbed headlines a few times in 2018 by announcing new connected car partnerships with Tata Motors Ltd. subsidiary Jaguar Land Rover in March, and with China’s electric car startup Byton on Thursday. Chen says these deals get the company’s name in the press, but don’t capture the full scope of the company’s QNX success.

“Every time we win a design on an autonomous platform, everybody wants to talk about it. But the bulk of the business comes from the high-end cars like Audi, Mercedes and BMWs and those that we have embedded software in it,” he said.

As for the business on which the company built its name, Chen says he has no intention of turning his back on its handheld mobile devices.

“I won’t stop doing it,” he said. “I will continue to do it as long as I have customers out there.”

Chen also weighed in on the contentious North American Free Trade Agreement negotiations, calling the current stand-off between the U.S. and its trading partners “part of the negotiation process.”

“I am an optimist,” Chen said. “I think this is all part of the negotiation process, although maybe the tactics are a little more aggressive than normal. But, I think it will all centre back into everybody get[ting] comfortable in a new paradigm or a new arrangement.”

However, he added, it’s not in anyone’s best interest for the current impasse to drag on.

“All these trade discussions and tensions right now are not going to help. Short-term we haven’t seen any negative impact yet. I think if it’s persistent, maybe longer term, we’re going to have a problem with every market being open. I am concerned about it.”