Nov 16, 2018

BlackBerry won’t seek ‘sizeable’ deals after US$1.4B Cylance takeover: Chen

BlackBerry Ltd.’s chief executive says the technology company will steer clear of “sizeable” acquisitions in the near future after announcing it’s buying California-based cybersecurity firm Cylance for US$1.4 billion in cash.

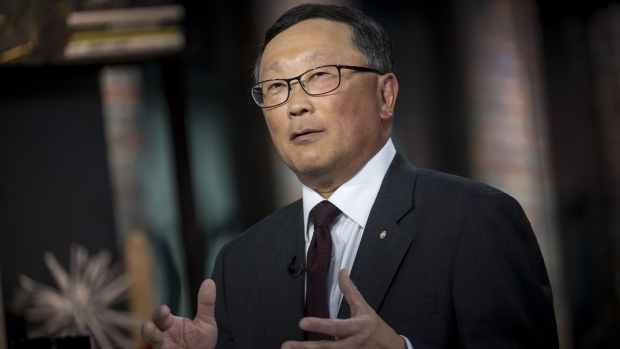

John Chen, CEO of BlackBerry, told BNN Bloomberg Friday that he doubts that Waterloo Ont.-based firm has “the bandwidth to integrate another company” in the short term.

“For the short and medium term, we’re not going to be acquiring any sizable assets,” Chen said. “But, if it’s a really small, tuck-in [acquisition], we will continue to look to do [so].”

BlackBerry announced Friday that it is buying Cylance in order to boost its existing software products with artificial intelligence capabilities. It is BlackBerry’s biggest deal in seven years, according to data compiled by Bloomberg.

BlackBerry has made a number of acquisitions recently in its shift from smartphones to software and security services.

Chen defended the US$1.4 billion takeover of Cylance, despite how the price tag makes up more than half of BlackBerry’s $2.3 billion in cash.

“We are generating cash, at least a little bit of cash, every year,” said Chen. “This is US$1.4 billion of that – more than 50 per cent, but we’re in good, good… financial shape.”

Chen also confirmed reports that Cylance was on the path to an initial public offering before the deal was struck.

“Because, strategically it fit so well with everything we do today and in the future, we were going after them,” Chen said.

“I think preventing them from going for an IPO is probably the wrong word. We were giving them an attractive alternative, which the [Cylance] board ultimately took.”