Hong Kong Developer Weighs Stake Sale in London Office Skyscraper Project

Hong Kong developer Lai Sun Development Co. is considering options for a planned office tower in the City of London, including a potential sale of a stake in the project.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Hong Kong developer Lai Sun Development Co. is considering options for a planned office tower in the City of London, including a potential sale of a stake in the project.

Germany’s financial regulator BaFin is taking a closer look at the real estate used by lenders to secure covered bonds known as Pfandbriefe, a €400 billion market traditionally considered among the safest in credit.

Taylor Wimpey Plc is failing to see lower mortgage rates translate into higher levels of home sales and is maintaining its forecast for fewer deals in 2024.

Chinese mainland investors increased their portion of total turnover of Hong Kong stocks to a record daily average in April, with the latest measures to bolster the city’s position potentially boosting their purchases.

Zhao Xiaowei did what would have been unthinkable just a few years ago: He quit his Beijing barista job and returned to his northeastern rust-belt hometown for a better future.

Mar 26, 2021

, BNN Bloomberg

In a note to clients Friday, BMO Senior Economist Robert Kavcic said policymakers may be hard-pressed to stand idly by as home prices post double-digit percentage gains not only in the nation’s largest markets, but in many outlying communities as well.

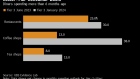

“Canadians in some markets are now buying houses, rural properties and cottages like they were buying toilet paper a year ago. Some areas are seeing prices up by a third, not from pre-COVID levels, but from just late last year, with widespread belief that there’s nothing to stop the momentum—after all, we’ve been told repeatedly that interest rates aren’t moving,” Kavcic said.

“One wonders now, assuming that interest rates won’t budge, if and when Ottawa is going to swing the policy hammer, and what that might look like.”

Over the course of the pandemic, average prices in Toronto and Vancouver – traditionally the nation’s priciest markets – have exceeded $1 million amid soaring demand and rock-bottom interest rates.

That heat has leaked into bedroom communities as work-from-home directives during the pandemic have allowed employees to move further afield. That’s pushed prices in the likes of Durham Region, just east of Toronto, nearly 30 per cent higher over the course of the last year, divorcing the residential real estate market from economic fundamentals.

Kavcic isn’t alone in speculating further action could be in the offing. In a note Wednesday, RBC Senior Economist Robert Hogue said policymakers should put every option on the table to curb rapid home-price appreciation, including “sacred cows” like a capital gains tax on the sale of a principal residence.

Absent any government intervention, there’s little sign that the central bank will do any heavy lifting when it comes to taking some heat out of housing. The Bank of Canada has pledged to keep its policy rate at the effective lower bound until at least 2023 as it aims to support an economic recovery from the ravages of the pandemic by providing low borrowing costs.