Apr 12, 2021

'Holy cow': Feds take stake in Air Canada as airline lands $5.9B in aid

, BNN Bloomberg

Expect more airline aid deals after Air Canada: AirTrav President Robert Kokonis

More than a year since COVID-19 started roiling the global aviation industry, Air Canada unveiled a long-awaited aid deal Monday evening that includes $4 billion in repayable loans and an equity stake for the federal government.

Under the agreement struck with the feds, Canada’s largest airline said that it will be able to tap as much as $5.879 billion in liquidity via the Large Employer Emergency Financing Facility (LEEFF).

According to a release from Air Canada, the arrangement includes the issuance of $500 million in Air Canada shares priced at $23.1793 apiece, as well as warrants for 14,576,564 shares priced at $27.2698 each over a 10-year span. If all of the warrants are exercised, the federal government would be left holding 14.1 per cent of Air Canada’s Class B shares, according to a release from the Canada Enterprise Emergency Funding Corporation, which administers the LEEFF program.

“It was really ‘holy cow’ – and not so much in terms of the amount of money, but the fact that the government of Canada is a shareholder in Air Canada again,” said industry consultant Robert Kokonis, president and managing partner of AirTrav, in an interview.

“I heard this rumour back in October that the government was potentially talking about some sort of public participation in equity but to see this was incredible.”

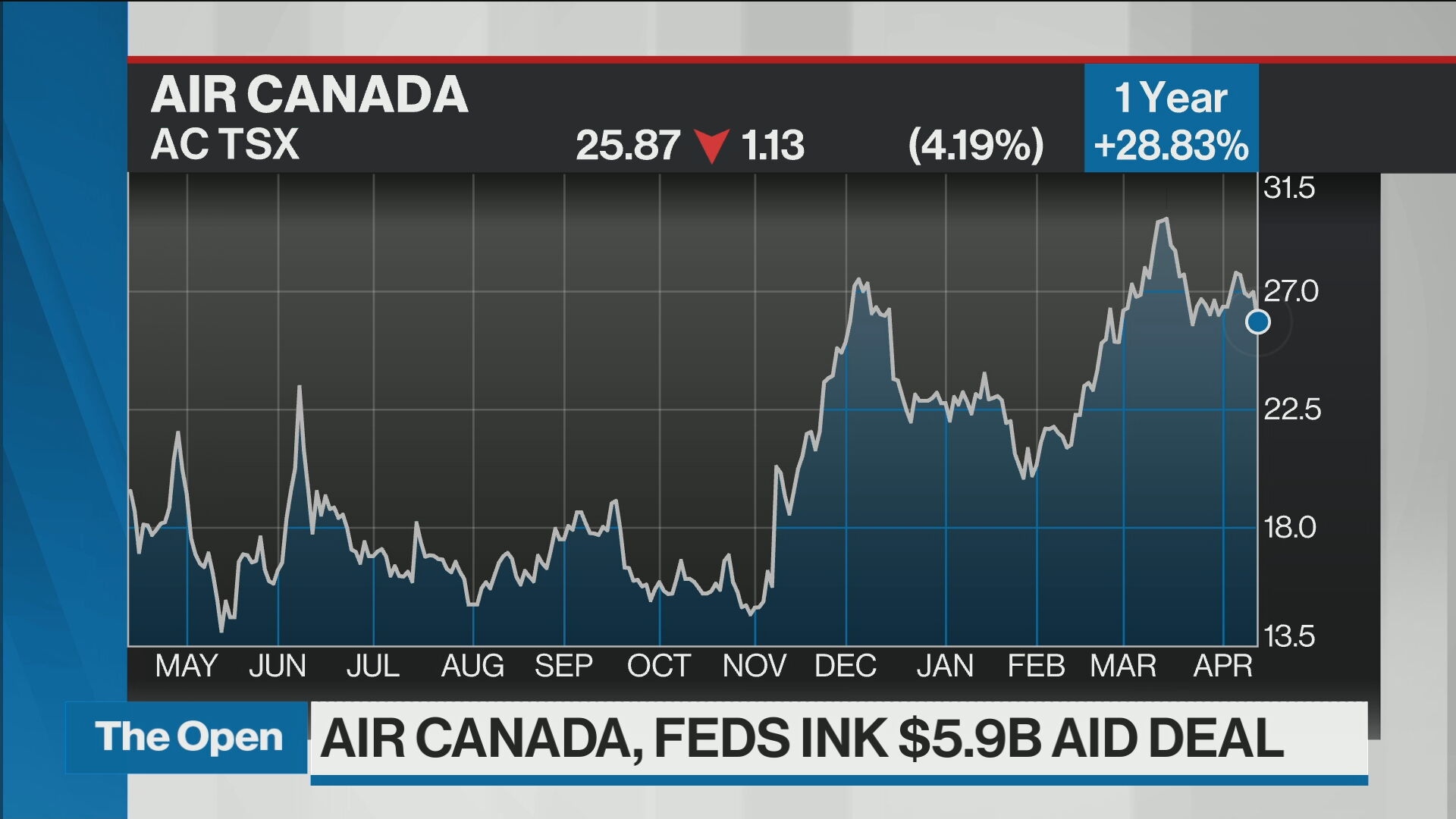

The package also includes a $1.5-billion secured revolving credit facility, $2.475 billion in three unsecured non-revolving credit facilities, and as much as $1.4 billion in an unsecured credit facility tranche specifically earmarked for supporting passenger refunds. Air Canada shares closed at $27.00 on the Toronto Stock Exchange Monday.

Air Canada said it has agreed to offer refunds to customers who purchased non-refundable fares and who were not able to travel since February 2020. The airline said in its release that it has also agreed to restrictions on some spending, dividends, share buybacks, and executive compensation. It will also proceed with its purchase of 33 Airbus A220 jets, which are being manufactured in Quebec.

The airline has also agreed to not allow its headcount to fall below its employment level as of April 1, and will either resume service on “nearly all” regional routes where service had been suspended due to the pandemic.

“The additional liquidity program we are announcing [Monday] achieves several aligned objectives as it provides a significant layer of insurance for Air Canada, it enables us to better resolve customer refunds of non-refundable tickets, maintain our workforce and re-enter regional markets,” said Air Canada President and Chief Executive Officer Michael Rousseau in the release.

“Most importantly, this program provides additional liquidity, if required, to rebuild our business to the benefit of all stakeholders and to remain a significant contributor to the Canadian economy through its recovery and for the long term.”

In a separate release, the federal government said negotiations are continuing for potential aid agreements with other airlines. In a news conference Monday evening, Deputy Prime Minister and Finance Minister Chrystia Freeland said that her deputy minister, former BCE Inc. and Caisse de dépôt et placement du Québec CEO Michael Sabia, personally led the negotiations with Air Canada.

“I’m confident this agreement sets a standard for how such interventions should be designed, with the interests of Canadians and workers coming first. This is a good and fair deal for Canada and Canadians,” Freeland said.