Mar 23, 2023

BOE Governor Says Global Banks are More Robust Than in 2008

, Bloomberg News

(Bloomberg) -- Bank of England Governor Andrew Bailey said the global banking system is more robust and better capitalized than in was in 2008, making a repeat of the crisis more than a decade ago unlikely.

“We’ve learned a lot of lessons in the financial crisis,” Bailey said in a pooled clip for broadcasters on Thursday. “Of course we keep learning lessons. I’m confident that in this country we are in a much stronger position. Their capital is stronger, their funding is stronger, and so far I think we’ve seen the signs that they’ve come through that robustly.”

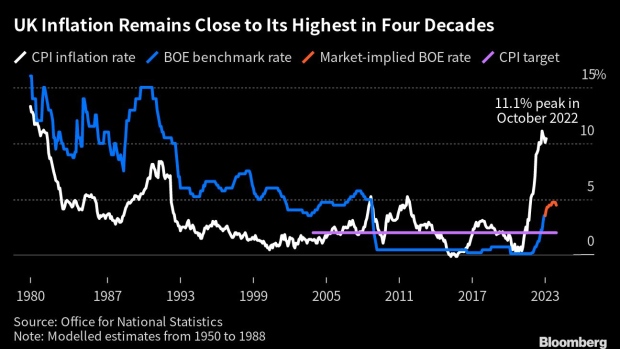

The remarks followed the BOE’s decision to raise interest rates a quarter point to 4.25%, brushing aside concerns that turmoil in financial markets will spill into the rest of the economy. The UK central bank is the latest to prioritize the fight against inflation over risks to the markets by continuing the quickest tightening in decades.

Together, those actions dashed hopes that the BOE and its peers will soon call a halt to rate rises. The pound rose, and investors priced in more certainty of at least one more rate hike later this year.

“Central banks will not ride to the rescue with rate cuts at the first sign of growth concerns, as we’ve been used to for a generation,” said Vivek Paul, chief UK investment strategist at BlackRock Investment Institute.

Bailey was upbeat about the outlook for the UK economy, saying households can “rely” on the soundness of the country’s banking sector after the turmoil that engulfed Credit Suisse Group AG and Silicon Valley Bank in recent weeks.

“I don’t think it’s a repeat of 2008 at all,” Bailey said. “We’ve obviously increased the regulation of the banking system since then.”

The BOE now expects the UK will avoid the recession it had predicted to start early this year when it last released official forecasts in February. Bailey also said he has seen signs of a “calming down” in price pressures and highlighted that the pace of private-sector pay increases may be cooling.

Bailey and his colleagues are seeking to keep a lid on soaring prices at a time when turmoil in financial markets is threatening to upend the outlook for the economy. The BOE warned that further rate rises may be needed.

“If there were to be evidence of more persistent pressures, then further tightening in monetary policy would be required,” minutes of the meeting released Thursday said, a guidance that’s in step with what the BOE said in February.

The BOE revised away its forecast for a recession in the first half of this year, saying it now expects a slight increase in gross domestic product in the second quarter instead of the 0.4% drop it anticipated in February.

Bailey said, “We’re much more hopeful of that and we’ve signaled that today.”

©2023 Bloomberg L.P.