Mar 22, 2023

BOE Grapples With Surprise Jump in UK Inflation

, Bloomberg News

(Bloomberg) -- The Bank of England is likely to continue the quickest series of interest-rate increases in three decades to quell a inflation that has accelleated contrary to its expectations.

Economists and investors anticipate policy makers will raise the benchmark lending rate a quarter point to 4.25%. That’s despite calls for a pause in the tightening to ease turmoil in financial markets after soaring rates unsettled the banking system.

Official data on Wednesday showing inflation climbed for the first time in four months solidified expectations for a hike. Traders almost erased bets that the BOE could pause rates to give a chance for markets, the banking system and consumers to absorb more than a year of increases in borrowing costs.

Policy makers at the UK central bank led by Governor Andrew Bailey will publish their decision at 12 p.m. in London on Thursday. They’re following a decision last week by the European Central Bank and US Federal Reserve on Wednesday to keep raising rates despite market concerns.

Read more:

- Powell Stresses Commitment to Cooling Prices as Fed Hikes Rates

- Lagarde Vows ‘Robust’ Policy With ECB Ready to Act as Needed

Following are the key elements expected with the BOE’s announcement:

Financial Stability

Minutes of the meeting show how Bailey and his colleagues are thinking about the turmoil in markets that came along with rescues for Silicon Valley Bank and Credit Suisse Group AG in the past few weeks.

While the BOE’s main mandate is to keep inflation to 2% at all times, it’s also supposed to identify and ward off threats to the stability of the economy. In more normal times, BOE officials say the two mandates can run in parallel — with rates controlling inflation while officials on the market regulation side of the bank clean up messes in the markets.

The swift increase in borrowing costs is starting to upend trading strategies that prevailed during the decade of easy money that prevailed between the global financial crisis in 2008 and the end of the pandemic. That led first to a flareup in a corner of the pensions industry in the autumn and then the collapse of confidence first in SVB and then at Credit Suisse. The concern is that further tightening do more damage.

To be sure, there is little evidence of UK-specific market stress. The bid-offer spread on 10-year UK government bonds — a measure of liquidity monitored by the BOE’s Financial Policy Committee — remains below levels seen in September and October. The pound, meanwhile, is the best-performing Group-of-10 currency so far this year.

Read more:

- HSBC’s £2 Billion Boost for SVB’s UK Unit Caps Frantic Weekend

- Fed and Global Central Banks Move to Boost Dollar Funding

- The Historic Week in Bond Markets Told Through Five Charts

- UBS to Buy Credit Suisse in $3 Billion Deal to Fight Crisis

- Bank of England Statement Says AT1 Notes Rank Ahead of Equity

What Bloomberg Economics Says ...

“February’s blowout CPI report means price stability will dominate concerns about global banking stress at the Bank of England’s March meeting. We expect the central bank to lift rates by 25 basis points. Our base case is that it is the final move of the tightening cycle. The risk is that rates end up being nudged a little higher.”

—Dan Hanson and Ana Andrade, Bloomberg Economics. Click for the PREVIEW.

Vote Split

Of the 42 economists surveyed by Bloomberg, only 11 expect no change in rates. The rest see a quarter-point increase to 4.25%, which would be the highest since 2008.

The median forecast is for the nine-member Monetary Policy Committee to vote 6-3 for an increase, with Silvana Tenreyro, Swati Dhingra and perhaps Deputy Governor Jon Cunliffe dissenting in favor of no change. The exact division will give a sense how much further rates may increase. Market bets now indicate rates could peak at 4.75% by August.

Read more:

- SURVEY REPORT: BOE to Raise Rates to 4.25%; Vote 6-3

Inflation Outlook

While the BOE won’t deliver a full set of forecasts on Thursday, it may provide a taste of how its thinking is evolving with fresh data out yesterday showing inflation jumped to 10.4% in February. It was the first increase in four months and defied expectations that price growth would slip below double digits for the first time in six months.

Those figures are a disappointment for the BOE, which along with the Office for Budget Responsibility expected CPI to average 9.7% in the first quarter and then to plunge rapidly toward the 2% target. They fuel concerns that inflation may be more persistent than the BOE hopes.

In February, the BOE said inflation may fall below target in the second quarter of next year. The OBR sees it reaching that level three months earlier.

As upward pressure on energy bills eases, the BOE is watching the labor market and especially wages for signs that factors at home will keep inflation high. Vacancies and the pace of pay increases have started to cool, but staff shortages leave the jobs market much tighter than usual.

Read more:

- Shock Jump in UK Inflation Pressures BOE Before Decision

- UK Inflation Surprise is the Largest Since 2009 Crisis: Chart

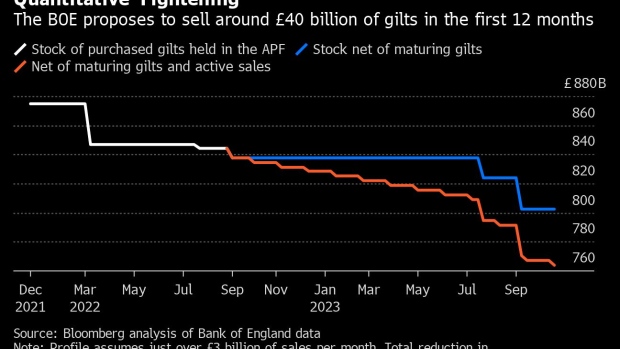

Quantitative Tightening

Some economists have called for a pause in the BOE’s program of asset sales — something that officials at the central bank had said they won’t reassess until this summer.

Last year the UK central bank started to offload the £875 billion ($1.1 trillion) of government bonds added to its balance sheet during a decade of quantitative easing purchases. It started by not replacing bonds that mature and since then stepped up to active sales of assets.

The portfolio topped out at £895 billion, including government bonds known as gilts and corporate bonds. The current plan is to reduce the portfolio by £80 billion over 12 months to this November, with £45 billion from active sales.

The pace of future sales will be keenly watched by both the government and the markets as the government must raise £305 billion next year, the second highest cash requirement on record. The BOE will be competing against the Treasury for investor appetite, which may push up government borrowing costs.

Read more:

- Bank of England Will Review Pace of QT Asset Sales This Summer

- UK Says BOE Losses on QT May Mean £200 Billion Hit for Taxpayers

--With assistance from Greg Ritchie, Tom Rees and Lucy White.

©2023 Bloomberg L.P.