Nov 3, 2022

BOE Hikes by 75 Basis Points But Rejects Market Rate Path

, Bloomberg News

(Bloomberg) --

The Bank of England delivered its biggest interest rate increase in 33 years but strongly pushed back against market expectations for the scale of future increases, warning that following that path would induce a two-year recession.

The Monetary Policy Committee voted 7-2 to lift rates by 75 basis points to 3%, the highest level in 14 years. But in an usually blunt comment on investors’ outlook for future hikes, it stressed the peak in rates will be “lower than priced into financial markets.”

Staying on the market path used in the forecasts, which peaks at around 5.25% next year, would knock 3% off GDP and ultimately push inflation to zero, the BOE said. An outlook based on rates staying at their current 3% level implies a shorter, shallower recession and sees inflation fall close to target in two years’ time.

“We think bank rate will have to go up less than what’s currently priced into financial markets,” BOE Governor Andrew Bailey said at a press conference. “That is important because, for instance, it means that the rates of new fixed-term mortgages should not need to rise as they have done.”

The remarks mark a sharp contrast with Federal Reserve Chair Jerome Powell, who said Wednesday that US rates will probably go higher than people are thinking. UK government bonds and the pound fell after the BOE’s decision. Investors had already tempered their view for UK rates, suggesting a peak around 4.75%.

What Blooomberg Economics Says ...

“The Bank of England’s decision to opt for a 75-basis-point hike in November looks like it could be a one-off as a deteriorating economic outlook and looming fiscal consolidation prompt the central bank to move less aggressively going forward. Its latest guidance suggests market expectations are still too high, though it has left itself the option to continue moving in steps bigger than 25 bps. We expect a 50-bp rise in December and for rates to peak at 4.25% in May, about 50bps below market pricing prior to the policy announcement.”

--Dan Hanson and Ana Andrade, Bloomberg Economics. Click for the REACT.

The swift surge in UK market interest rates has driven the cost of mortgages past 6% in recent weeks from around 1% at the end of last year when the BOE’s hiking cycle started. That’s roiled political debate about who is to blame for the UK’s economic plight.

Chancellor of the Exchequer Jeremy Hunt backed the BOE’s decision, saying it’s crucial to get inflation under control. He also expressed sympathy for households struggling with higher borrowing costs.

“Inflation is the enemy and is weighing heavily on families,” Hunt said in a statement. “Sound money and a stable economy are the best ways to deliver lower mortgage rates, more jobs and long-term growth. However, there are no easy options and we will need to take difficult decisions on tax and spending to get there.”

Rachel Reeves, the opposition Labour Party lawmaker who speaks on finance, blamed the Conservative government for soaring rates. She said the government “must face up to his mistakes that have led to the vicious cycle of stagnation this Tory government has trapped us in.”

The size of the hike announced Thursday will “reduce the risks of a more extended and costly tightening later,” the MPC said in the minutes to the meeting. The dissenters were Swati Dhingra, who voted for a half-point rise, and Silvana Tenreyro, who preferred a quarter point.

But while the BOE said more rate hikes may be required, potentially even “forcefully” if inflation pressures look persistent, the forecasts were a clear warning that market rate expectations have overshot.

The outlook sees inflation peaking at 10.9% in the coming months and falling to zero by 2025, but the minutes said the risks were to the upside.

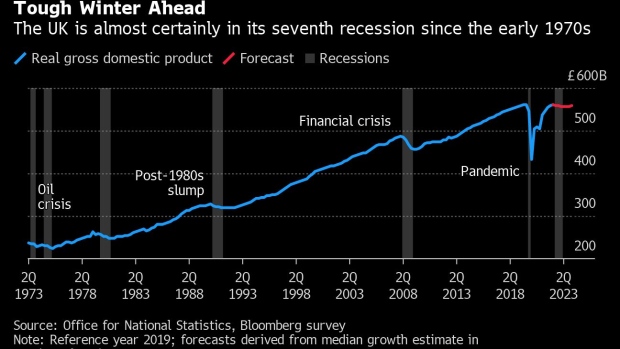

The BOE warned the UK economy faces a “very challenging outlook.” Its forecasts imply the UK is already in recession, and that GDP will fall for eight straight quarters until mid-2024.

GDP will fall thanks to “higher energy prices and materially tighter financial conditions,” the BOE said, signaling that elevated borrowing costs will hammer households and businesses.

Part of that tightening comes from the market chaos that followed former Prime Minister Liz Truss’s botched fiscal plan in September.

That sent mortgage rates soaring to 14-year highs, hurting households already suffering under a cost of living crisis caused by rising energy and food costs.

The bank estimates that the refinancing the average £130,000 mortgage at current rates would increase annual interest payments by £3,000. Around 2 million households will need to re-mortgage by the end of 2023.

Under the BOE’s central outlook using the market rate path, hundreds of thousands of jobs are lost as unemployment rises from 3.5% to 6.4%. Inflation falls to 1.4% in two years, well below the 2% target.

If rates are frozen at 3%, inflation falls back to 2.2% in two years, suggesting further rate rises may be needed, but then falls to 0.8% after three years.

Even then, the UK does not escape recession. GDP contracts 1.7% under the constant-rate scenario, thanks to a double-dip recession that sees just one positive quarter for growth between now and the end of 2023. Unemployment still rises to 5.1%.

The jumbo rate hike comes as the BOE is grappling with the highest levels of inflation in four decades with little sign that pressures are easing. Core inflation, which strips out volatile energy and food prices, is at 6.5% and private-sector regular wages are rising at a pace not seen in more than 20 years.

The BOE is also playing catch-up with the US Federal Reserve, which has raised rates by 75 basis points at four consecutive meetings to a range of 3.75% to 4%. The US central bank quashed market hopes for a pivot yesterday by signaling rates may move more slowly but to a higher-than-expected peak.

The BOE faces an even tougher balancing act. Higher rates threaten to bear down on growth just as the government imposes another round of austerity and tax rises.

Its forecast doesn’t take into account the fiscal consolidation due to be announced in an Autumn statement from the Treasury on Nov. 17, which is likely to squeeze GDP further. The BOE also assumes that the energy support package will remain universal but be roughly cut in half for the following 18 months after it ends in April.

The government has said it will consider more targeted support than its current £2,500 cap for the annual average household bill.

If support was to be £500 below the BOE’s midway assumption, inflation would be roughly 1 percentage point lower over the each of the first two years.

Read more:

- Jumbo UK Rate Hike Seen ‘as Dovish as Can Be’ as BOE Pushes Back

- Fed’s Latest Move Shows Hikes Will Be With Us for a While

- Pound Under Fire as Risk of Dovish BOE Haunts Market After Fed

--With assistance from Liza Tetley.

(Updates with chart.)

©2022 Bloomberg L.P.