Mar 7, 2023

BOE Policymaker Sees Signs of ‘Revival’ in UK Housing Market

, Bloomberg News

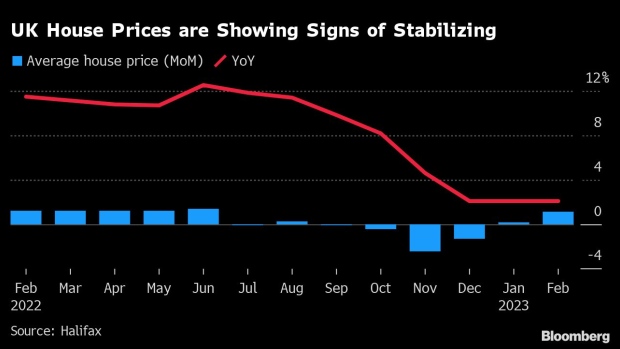

(Bloomberg) -- Bank of England rate-setter Catherine Mann sees signs of a “revival” emerging in the UK’s property market as Halifax reported the fastest rise in house prices since June.

“We see a reduction in mortgage rates from the high point last fall, we see more competition in terms of products coming from various lenders,” Mann said Tuesday in an interview on Bloomberg TV. “That suggests to me that there’s more revival in process as opposed to a continued downward momentum.”

Mortgage rates have risen sharply since last summer after being pushed higher by a string of BOE rate rises and the political turmoil caused by former Prime Minister Liz Truss. Activity in the property market has cooled and some indicators have reported a slump in prices but Halifax’s latest monthly report showed some signs of resilience.

Most forecasters expect house prices will decline this year, perhaps sharply. Nationwide Building Society recorded the quickest annual declines in prices since 2012, a sharp contrast with Halifax’s reading.

Mann played down worries over the impact a housing slump will have on households as falls are coming off the back of a huge 28% rise in prices since the pandemic struck.

“There is some price depreciation, but it’s really not much compared to how much prices on average appreciated over the last couple of years,” Mann said. “We have to take into account what the starting point was.”

Halifax said earlier Tuesday that prices rose 1.1% last month, the second increase this year, and by 2.1% from a year ago.

“Recent reductions in mortgage rates, improving consumer confidence, and a continuing resilience in the labor market are arguably helping to stabilize prices following the falls seen in November and December,” said Kim Kinnaird, director at Halifax Mortgages. “Still, with the cost of a home down on a quarterly basis, the underlying activity continues to indicate a general downward trend.”

The two mortgage lenders calculate average house prices based on the loans they’re making, which sometimes leads to divergence. Halifax had reported a sharper drop at the end of last year than Nationwide did.

“Based on the possibility that the Halifax measure is painting a more accurate picture of the housing market than its Nationwide counterpart, February’s strong gain in prices could be a reflection of mortgage rates falling back from their post-mini-budget peaks and a healthy labor market,” said Martin Beck, an economist at EY’s Item Club. “It also offers another sign that the economy is demonstrating unexpected resilience, despite the headwinds it is facing.”

Read more:

- UK House Prices Slide at Sharpest Annual Pace Since 2012

- UK Retailers Get Valentine’s Day Boost Despite Inflation Squeeze

- UK Mortgage Approvals Fall to Levels Seen in 2009 Housing Crash

©2023 Bloomberg L.P.