Aug 4, 2020

BOE Seen Signaling More Stimulus to Come: Decision Day Guide

, Bloomberg News

(Bloomberg) -- Bank of England officials could signal on Thursday that the case for more monetary stimulus is growing as a nascent rebound from the pandemic-induced recession risks fading.

While all analysts surveyed expect interest rates and the bond-buying target to be kept on hold for now, Bank of America Global Research, Goldman Sachs Group Inc. and Bloomberg Economics are among those predicting Governor Andrew Bailey will need to act again after the summer.

The central bank will provide an update on its growth and inflation projections, with BOE officials having to grapple with the fact that coronavirus cases are on the rise again in some parts of the nation. That’s casting a shadow over the government’s moves to reopen the economy, and sparking increasing concern over plans to end support programs for companies and workers.

What Our Economists Say:

“The focus will be on the central bank’s projections where we expect the recovery to look less ‘V-shaped’ than in May.”

--Dan Hanson, Bloomberg Economics

With borrowing costs so close to zero, investors are on the lookout for an update on the BOE’s review of the viability of negative rates, although officials may fall short of providing a definitive answer.

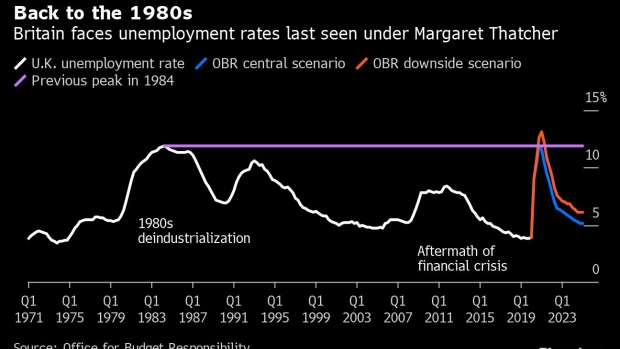

With government support for the labor market already being wound down and due to expire in October, the outlook for unemployment is emerging as a particular worry for the nine-member Monetary Policy Committee.

The central bank’s updated economic projections will give more indication of the BOE’s view of the shape of the recovery -- a matter that has divided some policy makers in recent weeks.

All economists also predicted officials will leave their asset-purchase target at 745 billion pounds ($973 billion). Policy makers will consider the pace of purchases, which was slowed when the plan was expanded in June.

The pause in action may prove temporary, with BofA expecting another package of measures in November, including a rate-cut to 0% and another 100 billion pounds of asset purchases.

Chief Economist Andy Haldane -- who voted against the last round of quantitative easing in June -- is optimistic about a quick recovery, while Silvana Tenreyro says the bounceback will probably be limited.

During the height of the pandemic, a lack of official data prompted the BOE to present a “plausible illustrative economic scenario” rather than harder forecasts. That scenario has so far proved to be somewhat more pessimistic than incoming data suggest. Returning to more formal projections is a move that is “long overdue,” according to Heteronomics Chief Economist Philip Rush.

Policy makers are still seen as generally aligned on their commitment to respond with more stimulus if needed, and may increasingly see the outlook for the labor market as more important, with even Haldane highlighting that as a major risk.

Chancellor of the Exchequer Rishi Sunak has spent more than 40 billion pounds helping more than 12 million workers since the crisis began -- an intervention that has helped keep the unemployment rate low.

Support is due to be tapered from this month, and economists are warning a “premature” withdrawal of government aid means more than 3 million will be out of work before the end of 2020. That would be the worst since the de-industrialization of Britain under Margaret Thatcher in the 1980s.

©2020 Bloomberg L.P.