Aug 2, 2021

BOE Sequencing Could Reshape U.K. Yield Curve: Liquidity Watch

, Bloomberg News

(Bloomberg) -- Gilt traders are bracing for the Bank of England’s review on policy sequencing, which could come as soon as this Thursday’s meeting.

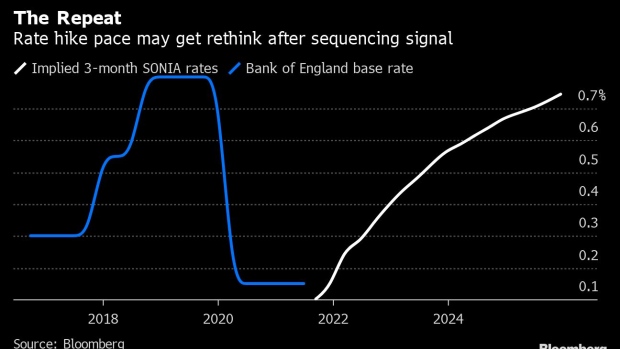

With no rate changes expected, the review -- on how the central bank will balance hikes with a reduction in government bond holdings -- will be a key driver of yields and the shape of the curve. Strategists expect a cut to the interest rate threshold that allows the BOE to reduce the stock of bonds, currently 1.5%. That could slow the pace of rate hikes by introducing an alternative tightening tool of trimming its debt holdings earlier.

This may keep short-term rates pinned as hike expectations get delayed, but drive long-end yields higher as the net supply of bonds rises, steepening the yield curve.

“Our economists expect the Bank Rate threshold for balance sheet roll-off to be reduced to 1.0% from the current 1.5%, with risks for a more aggressive reduction to a lower threshold,” wrote Morgan Stanley strategists including Alina Zaytseva. “Our bias is for gilt yields to move higher over the next few weeks.”

Conversely, a little-changed threshold would make short-term rates -- those most affected by the outlook -- more vulnerable as markets prepared for an uninterrupted series of hikes should the economic backdrop permit.

Sterling overnight index swaps are pricing a 15 basis point rate hike -- which would take rates back to 0.25% -- by around June 2022. The next 25 basis points to 0.50% isn’t priced until mid-2023.

That implies the Bank of England will not get close to 1.50% interest rates in the next hiking cycle, so a revision lower in the threshold is likely on the cards.

According to Morgan Stanley, there are other reasons to bet on higher yields beyond just the threshold rise including economic fundamentals that don’t justify current levels, an expected increase in Treasury yields and risks of a more hawkish quantitative tightening outlook.

Still, not everyone expects that the review is imminent. RBC economists suggested it may not come until November, citing comments from Monetary Policy Council members, according to a note Monday.

©2021 Bloomberg L.P.