May 4, 2021

BOE Weighs When to Taper Its Stimulus as U.K. Economy Rebounds

, Bloomberg News

(Bloomberg) -- Discover what’s driving the global economy and what it means for policy makers, businesses, investors and you with The New Economy Daily. Sign up here

The U.K.’s economic rebound from the pandemic is already fueling speculation that Bank of England policy makers this week will start discussing how and when they can ease their foot off the stimulus pedal.

The nine-member Monetary Policy Committee will maintain its target for 150 billion pounds ($209 billion) of bond purchases this year, a survey of economists shows. Some investors expect officials to slow the pace of buying so that the program stretches to the end of the year instead of ending abruptly in November.

Such a step may boost speculation that Governor Andrew Bailey and his colleagues will soon focus on when to unwind emergency measures to prop up the economy. Policy makers are almost certain to upgrade forecasts for growth and inflation alongside the decision due on Thursday.

“We think they probably will taper by a small amount, which the market is very ready for,” said Liz Martins, an economist at HSBC in London. “A more drastic reduction in the pace of purchases could be taken hawkishly.”

Bailey is attempting to encourage a strong recovery from the worst recession in three centuries without sparking inflation. A minority of analysts, notably Bank of America, Mizuho Financial Group Inc., Credit Suisse, ING Bank NV and NatWest Markets Plc, anticipate an announcement on May 6 to tweak asset purchases.

The BOE has been buying government bonds in financial markets at a pace of 4.4 billion pounds a week. At the current rate, that program would reach its overall target at the start of November, BOE Deputy Governor Dave Ramsden said in February. At the time, he said he’d “envision some further slowing in the pace at some point in the year.”

A slowdown in the pace of purchases wouldn’t impact the total amount of stimulus reaching markets, a contrast to the tightening seen last month by the Bank of Canada and the one traders are starting to expect from the U.S. Federal Reserve. For the BOE, trimming purchase may signal policy makers think the financial markets are robust enough to handle a shift.

The “total envelope is known, so tapering is about how the envelope is split across the year,” said Deutsche Bank analysts including Sanjay Raja. “It is not about the taper itself, but its information content. Does the likelihood of a further envelope go up or down? Are hiking expectations brought forward?”

What Our Economists Say ...

“The news flow since the Bank of England last published forecasts in early February has been unequivocally positive. That points to a big upgrade to its growth forecast for this year. But with the recovery still in its infancy, the central bank is likely to stress there’s a higher than usual bar for tightening policy and that it’s ready to loosen again if needed.”

-- Dan Hanson, Bloomberg Economics. Click here for the full PREVIEW

The BOE’s main rate currently stands at a record-low 0.1%, and bets on hikes have accelerated recently. Traders price in 13 basis points of increases in August 2022 compared to about 6 points a little over a week ago. Yields on the benchmark 10-year gilt have surged to 0.84% on Friday from 0.2% at the start of the year.

Banks are divided over whether tightening bets have gone too far. NatWest and Deutsche Bank recommend bets that the BOE won’t tighten as quickly as current market pricing suggests.

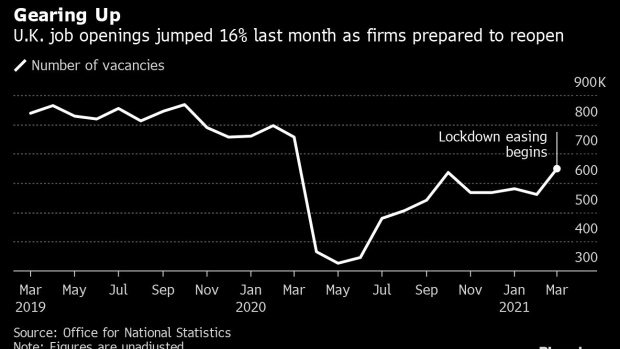

Still, recent surveys support the idea that the economy is recovering rapidly -- even more quickly than the BOE forecast in February. Purchasing managers said activity was the strongest in seven years in April. Retail sales jumped in March. Online job advertisement and discretionary spending on credit and debit cards are back above pre-pandemic levels.

“The question is how much more optimistic they can appear to be without jinxing markets and fueling some unwanted rate expectations at this stage,” said Fabrice Montagne, an economist at Barclays Plc.

The BOE has said it won’t tighten policy until there are signs that inflation will remain sustainably above its 2% target. For the moment, the consumer price index has stuck below that level for 1 1/2 years, with the last two readings coming in below economists forecasts.

©2021 Bloomberg L.P.