Mar 21, 2022

Boeing’s tenuous recovery in China shaken by latest 737 crash

, Bloomberg News

China Eastern Airlines Boeing plane with 132 people aboard crashes in southern China

Boeing Co. faces a new crisis after a 737 jet fell out of the sky in China, renewing concerns about its best-selling family of planes and extending one of the most turbulent periods in the aviation titan’s century-long history.

The 737-800 aircraft operated by China Eastern Airlines Corp. nose-dived Monday into mountainous terrain with 132 people on board, prompting the carrier to ground its fleet of the workhorse jets. The model is part of the so-called “next generation” of 737s that have amassed a good safety record since they were introduced in the 1990s.

The tragedy casts a harsh spotlight on Boeing after two of its 737 Max jets, the latest version of the narrow-body, plunged to earth in 2018 and 2019, killing 346 people and leading to one of the longest groundings in aviation history.

The latest incident didn’t involve a Max. Still, it’s a setback for Boeing’s efforts to rebuild confidence in its safety culture and 737 family of jets, the company’s largest source of revenue. It also jeopardizes the Chicago-based manufacturer’s nascent recovery in China, a critical step needed to rebound from three years of financial losses. Boeing had been on the verge of returning its Max aircraft to commercial service in the country, whose regulators were the first to ground the model in 2019.

Monday’s crash “comes at an extremely delicate time, with Boeing finally aiming to re-start 737 Max deliveries into China after a three-year halt,” Seth Seifman, an analyst with JPMorgan, said in a note to clients. “Chinese authorities’ comments in the coming days and weeks will, therefore, be critical for gauging the impact of this tragedy on Boeing’s recovery.”

Boeing said Monday that it’s supporting its airline customer and is prepared to assist authorities in the U.S. and China. Its shares fell 3.6 per cent to US$185.90 at the close of trading in New York and have tumbled 7.7 per cent so far this year.

NEAR-VERTICAL PLUNGE

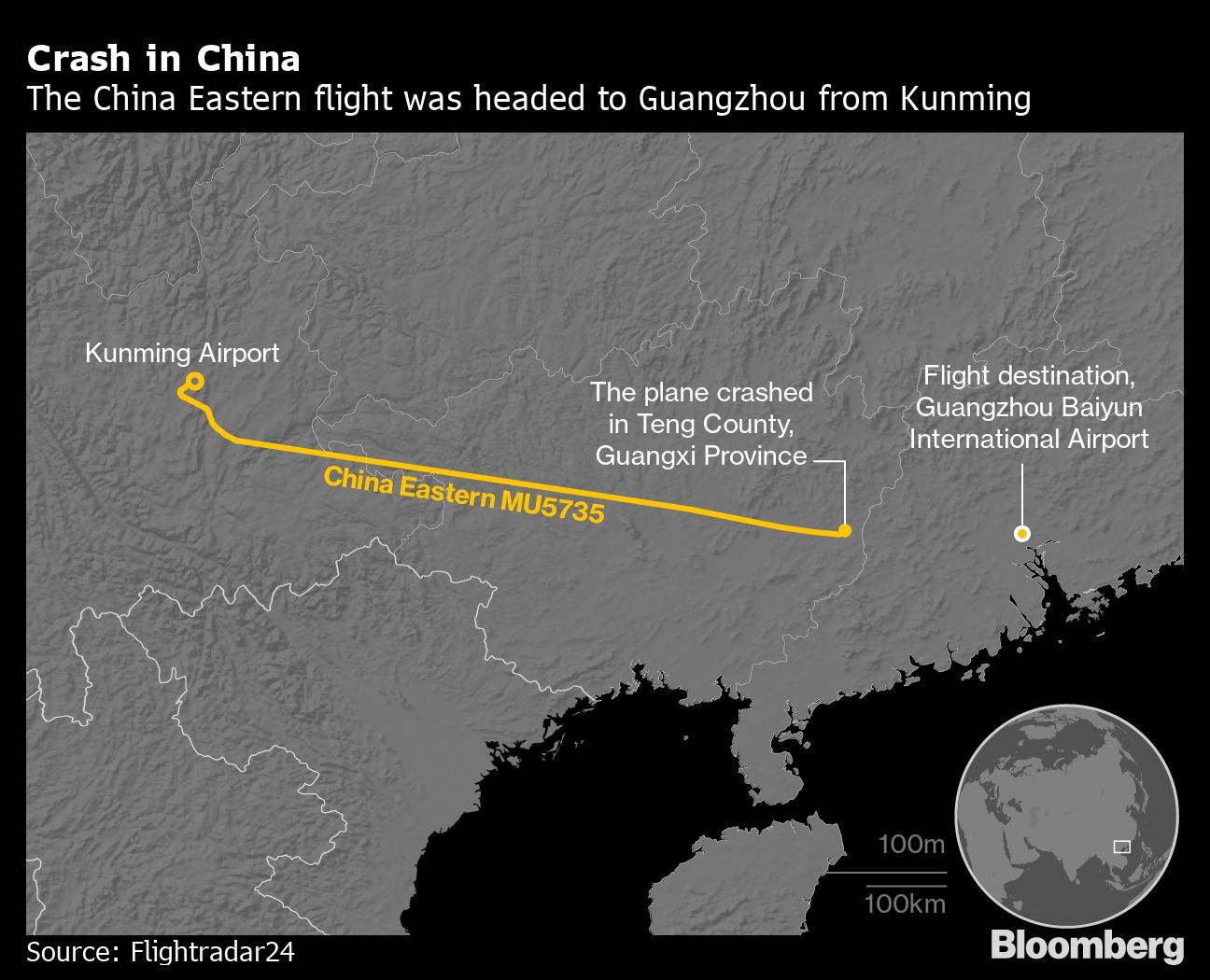

Flight MU5735 was cruising more than an hour into its flight from Kunming, the capital of China’s Yunnan province, to the port city of Guangzhou when it plunged sharply. The maneuver would have likely flung objects and any unbelted passengers violently to the ceiling. In just seconds the jet went from level flight to a descent rate of almost 31,000 feet per minute, according to data posted by FlightRadar24.

But after about 45 seconds, the descent became less steep and for a few moments the jet climbed by more than 1,000 feet. It went from 7,425 feet up to 8,600 feet in about 10 seconds, according to the FlightRadar data, which is based on information transmitted by the plane. Just as the earlier dive would have flung items to the ceiling, the climb would have created huge gravitational forces, pinning people in their seats.

The climb was short-lived. The jet resumed its dive seconds later. Its last position recorded on the FlightRadar track was at 2:22:36 p.m. local time, about a minute and 35 seconds after the sudden descent began. Video footage showed the aircraft plunging at a near-vertical trajectory behind a mountain side in China’s Quangxi region.

BOEING EFFECTS

While investigators searched for clues to the disaster, investors fretted about the implications for the embattled planemaker.

China’s airlines have been among the largest customers for the 737. Before the Max grounding, the nation took as many as one-third of the narrow-body jets that rolled out of Boeing’s Seattle-area factory each year. In a sign of the potential thawing in its largest overseas market, Boeing last week sent the first Max across the Pacific Ocean since the jet’s grounding to its Chinese delivery center south of Shanghai.

China has the largest 737-800 fleet, with nearly 1,200, according to IBA Group Ltd., an aviation consultancy. It also has the youngest fleet, with an average age of just over eight years. The U.S. has the next largest fleet, followed by Ireland, the Russian Federation and Turkey, according to IBA.

After burning through more than US$20 billion in grounding-related costs, Boeing’s financial turnaround hinges on its ability to resume shipping 737s at a higher volume. Executives had targeted delivering around 500 Max jets this year, with China’s airlines taking their first Boeing narrowbodies in three years.

That target is already in question after a sluggish start, Seifman said. The pace of production will also be closely watched for the impact on suppliers such as Spirit AeroSystems Holdings Inc., which manufactures most of the jet’s airframe for Boeing.

What Bloomberg Intelligence Says

“The event may extend the time it takes for the original-equipment manufacturer’s bonds to narrow the discount at which they trade to triple-B tier industrial peers. Paring inventory and generating cash are key to cutting debt and relieving strain on the company’s financial-risk profile.”

-- Matthew Geudtner, BI credit analyst

The crash also raises the potential for more confusion and backlash among travelers, some of whom avoided flying on the Max after the damaging revelations that emerged from the earlier accidents.

Then-Chief Executive Officer Dennis Muilenburg was ousted for his handling of the crisis in 2019 as Boeing faced scrutiny from Congress, regulators and law enforcement. In recent weeks, the company’s safety lapses have been highlighted in “Downfall: The Case Against Boeing,” a Netflix documentary.

“Given BA’s problems with the 737 Max, there is some chance that consumers may not want to fly on a 737 until the cause of the China Eastern crash is determined not to be a design or manufacturing issue,” Cowen analyst Cai von Rumohr said in a note, referring to Boeing by its stock symbol. “Hence, isolating the cause of the crash will be critical.”

It’s too soon to know what caused the China Eastern accident, and investigations can take months or years to unfold. The lost airplane was relatively young, flying commercially for about seven years. Leading causes of such accidents tend to be maintenance issues, pilot error or sabotage, with design or manufacturing issues less likely, von Rumohr said.

Boeing has delivered more than 7,000 jets from its 737NG lineup, making it the best-selling aircraft family in the planemaker’s history. The company delivered the final passenger version in 2019, although it still uses the frame for military aircraft like the sub-hunting P-8 Poseidon.

The single-aisle jets are a staple of U.S. domestic flying. Among the largest U.S. airlines, American Airlines Group Inc. has the most 737-800s, with 267 in service and 36 temporarily stored at the end of 2021, according to a regulatory filing. Southwest Airlines Co. has 207, while United Airlines Holdings Inc. has 141 and Delta Air Lines Inc. has 77.

United said it’s in contact with Boeing and the FAA about the China Eastern crash while still flying its 737-800s. Delta’s aircraft are “operating safely and routinely,” a spokesman said, declining to comment further. American referred questions to the FAA.