Oct 6, 2020

Boeing sees pandemic clipping global jet sales 11% this decade

, Bloomberg News

Boeing Co. sees a turbulent ride ahead for the world’s jetliner market, with sales contracting sharply this decade before eventually rebounding in the 2030s as new models and technologies spur growth.

In its first long-term forecast since the coronavirus pandemic upended travel, Boeing predicted that global planemakers will deliver 18,350 commercial aircraft through decade’s end. That’s 11 per cent fewer than the company expected a year ago, before the virus sapped demand for travel and new planes.

The outlook underscores the deep slump afflicting global aviation, with years of torrid airline growth giving way to a fight for survival until a vaccine or treatment coaxes more consumers back to the skies. Boeing released the report days after deciding to consolidate production of its marquee 787 Dreamliner in South Carolina, shutting down a final assembly line at a storied plant in Everett, Washington, to save money.

“We’re a long way from the bottom, which was mid-April, and it’s a long way back from here to full recovery,” Darren Hulst, Boeing’s vice president of commercial marketing, told reporters in a briefing before the forecast was made public.

Boeing pared early gains and fell 3.5 per cent to US$165.22 at 12:02 p.m. in New York. The shares plunged 47 per cent this year through Monday, the worst performance on the Dow Jones Industrial Average.

Long Slog

The Chicago-based aerospace titan typically releases a 20-year commercial outlook at the industry’s annual mid-summer trade expo, which was canceled this year.

Boeing also decided to provide a 10-year snapshot to help illuminate a marketplace ravaged by COVID-19. The assumptions underpin the flurry of production rate cuts the company has made this year, as well as a sweeping review of its businesses, overhead, investments and suppliers.

Airbus SE, Boeing’s European rival, doesn’t plan to share its crystal ball.“In the current, unprecedented context, it is too early for Airbus to issue a new forecast,” Stefan Schaffrath, a spokesman for the Toulouse, France-based company, said in an email. “Our analysis of the global market environment and the direct feedback we are getting from customers worldwide indicate that this crisis will go well beyond 2021, with air traffic not expected to recover to pre-COVID levels before 2023 at best, maybe even 2025.”

At the worst of the coronavirus crisis, about two-thirds of the global jetliner fleet was parked along airport taxiways and in storage lots. While about 500 a week of those jets returned to the skies during June and July, the recovery has stalled.

The shock will reshape airlines and the trends that have governed jetliner sales for the past 15 years. Gone is the expansion mania of the past decade. Looking ahead, more sales -- around 56 per cent of this decade’s total -- will be driven by airlines looking for greener, more fuel-efficient models to replace older jets, Hulst said.

Boeing expects fewer carriers to “up-gauge,” or switch to bigger jets, particularly on domestic flights, Hulst said.

In the market for single-aisle planes, the company expects demand to gravitate to the 160-to-180-seat range served by its 737 Max 8, which has been grounded since March 2019 following two crashes that killed 346 people. While the Max’s flying ban could be lifted in the coming months, the model faces a tough competitor in Airbus’s A320 family of jets.

Wide-Body Weakness

For sales of twin-aisle planes, the focus will be on midsize aircraft, especially in the next five-to-10 years, Boeing said. Demand for flying behemoths such as the 777X -- the company’s newest model -- will be the last to recover.

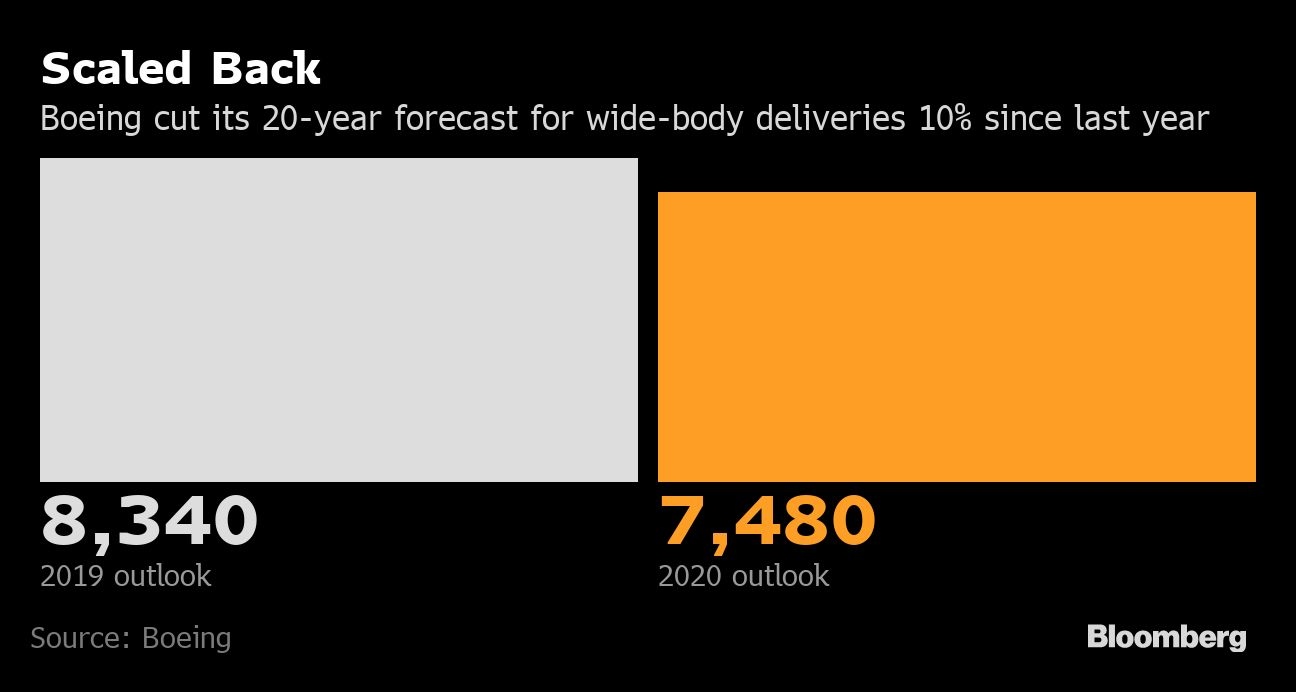

This decade will be especially rocky for the wide-body sector that Boeing dominates. The planemaker forecasts 3,060 total deliveries, 15 per cent fewer than a year ago. It also cut its forecast by 11 per cent in the market for single-aisle planes, the lucrative market segment where Airbus has a commanding lead. The outlook for deliveries of regional jets improved slightly.

Boeing predicted a total market value of US$2.9 trillion for commercial jets during the 2020s, without providing a comparable forecast from a year ago. Including defense, space and services, the market will be US$8.5 trillion over the period, down US$200 billion from a year ago.

Growth will eventually pick up in the 2030s, Boeing said. Still, the company lowered its forecast of total deliveries over the next 20 years to 43,110 aircraft. That’s about 2 per cent less than Boeing predicted a year ago, with wide-body jetliners especially hard hit.

--With assistance from Charlotte Ryan and Tony Robinson.