Oct 30, 2020

BofA Predicts December Bond Rush From Latin American Borrowers

, Bloomberg News

(Bloomberg) -- Latin American borrowers may move swiftly to tap U.S. dollar bond markets once election volatility fades, according to Max Volkov, head of Latin America debt capital markets at Bank of America Corp.

“My message to issuers going into 2021 is come in early, come in large size and come in long-dated,” Volkov said in an interview Tuesday. “In December there could be a rush to issue,” said Volkov, who predicts front-loaded funding by large sovereign borrowers that would typically wait until January.

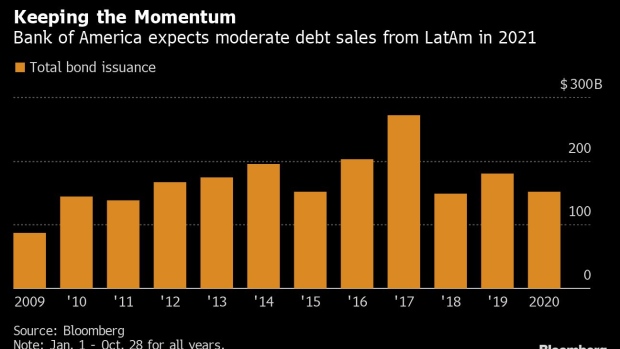

Governments accounted for about 40% of the $152 billion in new Latin American debt this year, according to data compiled by Bloomberg. Financial institutions were the next largest borrowers, and Volkov expects that to sector to remain active in 2021.

Volkov expects coupons to stay low for the next three to six months, adding an incentive to issue. “Financing costs right now are so attractive,” he said.

Refinancing will be a major driver of 2021 fundraising, with up to $175 billion of corporate Latin America debt and about $60 billion from governments due in the next five years, according to Volkov.

Environmental and social projects will also boost bond sales from the region next year, Volkov said. The pandemic has boosted sustainable debt, including record social bond issuance.

“ESG is a trend that is with us to stay and only gets stronger,” he said. “The number of discussions we’re having with clients is staggering.”

Volkov noted robust demand for Brazilian paper producer Suzano SA’s $750 million sustainability-linked bond and Coca-Cola Femsa’s debut $705 million green bond. This resulted in better pricing for the issuers, added Volkov, who worked on the deals.

Bank of America has been involved in about 7.3% of this year’s Latin American bond sales, making it the fifth biggest underwriter in the region, according to Bloomberg rankings.

©2020 Bloomberg L.P.