Jan 13, 2023

BofA Reaps Benefits of Interest-Rate Hikes, Trading Volatility

, Bloomberg News

(Bloomberg) -- Bank of America Corp. traders beat analysts’ estimates as they reaped the benefits of dramatic market swings, and lending income rose along with interest rates while falling short of expectations.

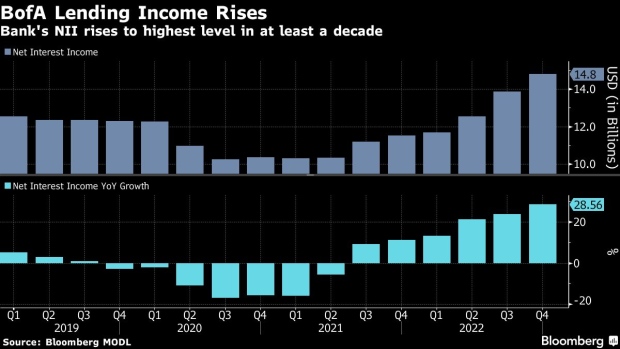

Net interest income, the revenue collected from loan payments minus what depositors are paid, rose 29% to $14.7 billion in the fourth quarter on higher rates and loan growth, though the increase was smaller than forecast. Trading revenue soared 27% from a year earlier, with the best results in fixed income, more than the 13% gain analysts had expected.

“We ended the year on a strong note growing earnings year over year in the fourth quarter in an increasingly slowing economic environment,” Chief Executive Officer Brian Moynihan said in a statement Friday.

Bank of America’s $3.72 billion in quarterly trading revenue was helped by fixed income, where revenue shot up 49%. The increase in trading revenue was spurred by the higher rates, soaring inflation, recession fears and global political turmoil. The company has been investing in an expansion of the fixed-income business.

Higher loan revenue combined with the increase in trading revenue lifted earnings to $7.13 billion, and per-share earnings beat analysts’ expectations. The results offer another look at how Wall Street finished a year marked by a shaky economic outlook.

Shares of Charlotte, North Carolina-based Bank of America were little changed at $34.24 at 9:59 a.m. in New York. They’ve declined more than 30% in the past 12 months.

Bank of America’s non-interest expenses rose 5.5% from a year earlier to $15.5 billion. Costs have been a focal point for investors with persistent inflation putting pressure on spending and wage growth across the globe. Overall headcount jumped to 216,823 in the quarter, higher than the 208,248 the company had a year earlier and the 213,270 reported in the previous three months.

In contrast to its competitors on Wall Street, Bank of America has no plans for massive job cuts in an uncertain economic environment, Chief Financial Officer Alastair Borthwick said on a conference call with reporters Friday.

Bank of America also increased provisions for credit losses to $1.09 billion in the fourth quarter. That follows $898 million in the previous three months. That included $403 million of reserve builds, hurting overall earnings.

Investment-banking revenue fell 54% to $1.09 billion, worse than analysts expected as the same market tumult that drove trading up muted dealmaking. Fees for advising on mergers and acquisitions declined 43%. The underwriting of equities deals fell 65% to $189 million, a smaller decline than analysts expected, while debt underwriting slumped almost 58%, worse than the projections of a 44% decline.

The company’s loan balances rose to $1.05 trillion at the end of the fourth quarter, up 6.8% from a year earlier and more than analysts’ estimates of roughly $1.04 trillion. Lending has been a key focus for investors, with government-stimulus payments first undercutting borrowing by companies and consumers during the pandemic, and rising interest rates then making loans costlier.

Also in Bank of America’s fourth-quarter results:

- Net income 1.7% to $7.13 billion, or 85 cents a share. Adjusted earnings were expected to total 78 cents, the average estimate in a Bloomberg survey.

- Companywide revenue totaled $24.5 billion, beating analysts’ estimates.

- Client balances in wealth and investment management dropped 12% to $3.4 trillion.

(Updates with shares in sixth paragraph.)

©2023 Bloomberg L.P.