Oct 18, 2022

BofA survey 'screams' capitulation with rally set for early 2023

, Bloomberg News

TSX better positioned than S&P500 in a downturn: Ohsung Kwon

The sentiment on stocks and global growth among fund managers surveyed by Bank of America Corp. shows full capitulation, opening the way to an equities rally in 2023.

The bank’s monthly global fund manager survey “screams macro capitulation, investor capitulation, start of policy capitulation,” strategists led by Michael Hartnett wrote in a note on Tuesday. They expect stocks to bottom in the first half of 2023 after the Federal Reserve finally pivots away from raising interest rates.

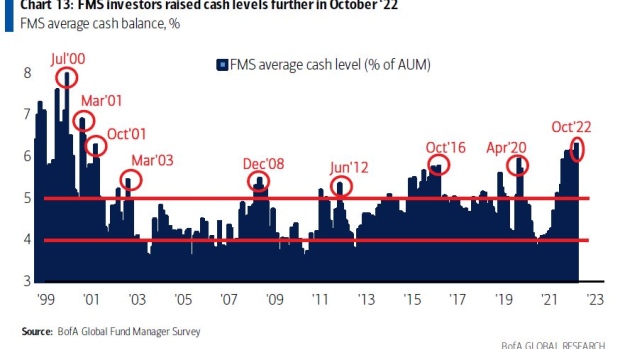

“Market liquidity has deteriorated significantly,” the strategists said, noting that investors have 6.3 per cent of their portfolios in cash, the highest since April 2001, and that a net 49 per cent of participants are underweight equities.

Nearly a record number of those surveyed said they expect a weaker economy in the next 12 months, while 79 per cent forecast inflation will drop in the same period, according to the survey of 326 fund managers with $971 billion under management, which was conducted from Oct. 7 to Oct. 13.

“While the stock market was immune to the bleak sentiment till last month, it has started to better reflect investors’ pessimism,” Hartnett wrote.

As the earnings season gains traction, 83 per cent of investors expect global profits to worsen over the next 12 months. A net 91 per cent said global corporate profits are unlikely to rise 10 per cent or more in the next year -- the most since the global financial crisis -- a sign that suggests further downside to S&P 500 earnings estimates, according to the strategists.

Global equities have rallied in recent days amid support from technical levels, changes in U.K. government policies and a focus on earnings. Hartnett and his team described the rally after a US inflation print last week as a “bear hug.”

Other survey highlights include:

- In absolute terms, investors are most bullish on cash, health care, energy and staples, and most bearish on equities, U.K. and Eurozone stocks, as well as bonds

- The most crowded trades are long U.S. dollar, short Europe equities, long ESG assets, long oil, short emerging markets/China debt and equities as well as short UK debt and equity

- A record high share of 68 per cent see the dollar as overvalued

- Investors see European sovereign-debt markets as the most likely source for a systemic credit event

- Investors see rising odds of a policy pivot in the next 12 months, with 28 per cent of participants seeing lower short-term rates within that timeframe