Mar 8, 2023

BOJ Governor Kuroda’s Last Meeting Has Markets Focused on a Final Surprise

, Bloomberg News

(Bloomberg) -- The Bank of Japan will conclude Governor Haruhiko Kuroda’s final meeting Friday, with global investors remaining on high alert for a surprise parting shot from Kuroda that may jolt financial markets around the world.

Some 46 of 49 economists forecast no policy change at the end of the two-day gathering, according to a Bloomberg survey. Still, Goldman Sachs and BNP Paribas are among the minority flagging the risk of Kuroda adjusting or scrapping the central bank’s yield curve control program as he draws the curtain on his 10-year stint helming the BOJ.

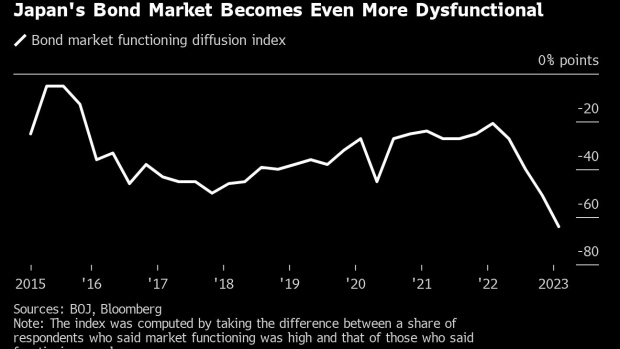

Market speculation has been fueled by the fact the lack of improvement in bond market functioning, despite the BOJ widening its 10-year yield target range in December to address precisely that. The move also cemented Kuroda’s reputation for taking markets by surprise.

Kuroda would also be breaking custom with past BOJ governors if he decides on a major shift at his last gathering. Since the bank began to release policy statements regularly in 1998, none of the four governors who preceded Kuroda have made a policy change at their final meeting.

Most BOJ watchers don’t see Kuroda moving toward tightening on Friday, as it will risk turbo-charging speculation over more change to follow when governor nominee Kazuo Ueda is set to take over at the bank in a month’s time.

Read More: Broken Bond Market Leaves Door Ajar for One Last Kuroda Surprise

Still, the BOJ’s quarterly bond market survey showed a gauge of bond market functioning deteriorating to a record low earlier this month, keeping alive expectations that more action needs to take place.

The BOJ is leaning toward monitoring the impact of recent tweaks to its yield curve control rather than making another adjustment at this gathering, people familiar with the matter told Bloomberg last week.

During parliamentary hearings through Feb. 27, Ueda indicated that he wants to take time before making any drastic change to the BOJ’s monetary easing. Ueda’s nomination is expected to win formal parliament approval on Friday.

The BOJ typically releases its policy statement around noon, followed by Kuroda’s press conference at 3:30 p.m.

What Bloomberg Economics Says...

“The outgoing governor will probably stay clear of sending any signals about potential policy adjustments, wanting to leave his successor free to maneuver.”

Yuki Masujima, economist

Click here to read the full report.

Here is what to look for

- Whether the BOJ widens or ditches its 10-year yield target band is a key market question for this meeting. If that happens, it would suggest Kuroda pushed strongly for it, given a few board members have indicated they would prefer to take more time to monitor developments in bond market functioning.

- On the other hand, no move on the YCC would crystallize the fact that the BOJ is prioritizing monetary stimulus. That would temper some market views that accumulated side effects have become a primary and imminent concern for the central bank.

- Some BOJ watchers have warned of the possibility of a tweak to the forward guidance for interest rates. The BOJ could neutralize its easing bias by adjusting wording that states rates are expected to stay low or lower, they said.

- The BOJ could downgrade or tweak its assessment of the overall economy after weakness in production has become clearer, in a sign of downward pressure from the global economic slowdown. That would paint a more dovish picture for the bank.

- Kuroda is likely to keep trying not to give any hint of the policy path under his successor, but BOJ watchers will be scrutinizing his words on wages and inflation in a bid to judge the state of progress toward the BOJ’s 2% stable price target.

- Currency traders will be watching Kuroda’s tone on the need for monetary stimulus after Federal Reserve Chair Jerome Powell hinted at the possibility of re-accelerating the pace of rate hikes in March. The yen has steadily weakened over the past month, although it’s still a way off from last year’s peak.

©2023 Bloomberg L.P.