May 30, 2023

BOJ to Hold Policy Amid Election Chatter, Ex-Board Member Says

, Bloomberg News

(Bloomberg) -- The Bank of Japan will refrain from changing its yield curve control program while speculation continues to swirl that Prime Minister Fumio Kishida will call a snap election, according to a former board member.

“It’s going to be pretty tough” for the bank to raise rates in July, former board member Makoto Sakurai said in an interview Tuesday, adding that economists and market watchers may also have underestimated the central bank’s continued concern about the financial sector. “The BOJ will probably keep watching developments at least until around the third quarter.”

If the premier goes to the polls early, Sakurai sees an election in September as more likely than in the summer given the setback for Kishida of having to fire his son over party photos at the prime minister’s official residence.

Sakurai’s view is at odds with many BOJ watchers, including those at Goldman Sachs and Barclays, who expect a central bank move in July.

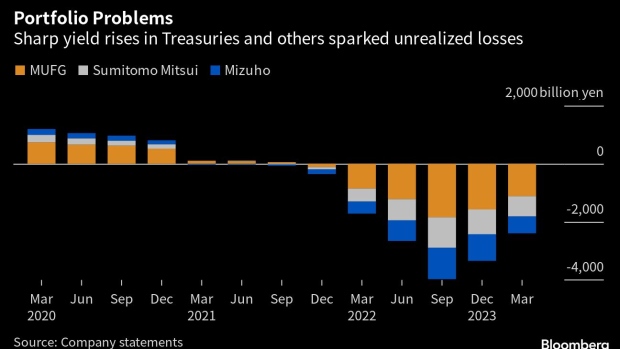

Those BOJ watchers expecting a tweak in the yield control in July, together with an upgrade of the bank’s inflation forecast may be underestimating how much the US banking crisis earlier this year has impacted the Japanese central bank’s thinking, Sakurai said.

In addition to direct hits to Japanese banks’ foreign bond holdings, the crisis revealed the risk of raising rates after years of monetary easing, he said. After more than two decades of zero rates or lower, Japan’s financial system is particularly vulnerable to even a small increase in interest rates, he said.

The chance of a rate hike from the BOJ this year is “fifty-fifty,” Sakurai said. “Even if they can do it, the ceiling will only be raised to 0.75%” from the current 0.5% for 10-year bond yields, he said.

The next BOJ meeting is scheduled for June 15-16. After Governor Kazuo Ueda indicated that a policy change is likely to come with a shift in the outlook for inflation, attention has been focusing on July, when the bank will release its latest quarterly economic projections.

Raising rates also risks cooling positive momentum in the economy before an election, Sakurai said. He was known for his closeness to BOJ officials before his term ended in March 2021, including then Governor Haruhiko Kuroda.

“BOJ officials at the very top level are probably most interested in the timing of the election right now,” Sakurai said. “Their honest feeling is that they can’t move until it’s over” as they want to stay away from risking disrupting positive developments in inflation and corporate profits, he said.

Acutely aware of the risk of imposing a burden on the financial system with a rate hike, the BOJ could announce it will pay interest to banks to cushion the negative impact when they raise rates, Sakurai said.

“The BOJ is very good at mitigating harmful impacts after having done this many times,” Sakurai said. The BOJ’s three-tier system for bank deposits that was introduced to cushion the impacts of negative interest rates is one example of steps the central bank has taken to soften the blow from policy decisions.

Ueda isn’t in a rush but appears determined to make gradual changes in policy toward normalization, Sakurai said. The shifts include the scrapping of interest rates guidance at his first policy meeting in April, he said.

“That may be a stealth step” toward normalization, Sakurai said. “Little by little, he is doing what he can while he can.”

©2023 Bloomberg L.P.