Dec 20, 2022

BOJ Tweaks Could Be First Step Toward Exit, Takatoshi Ito Says

, Bloomberg News

(Bloomberg) -- The Bank of Japan’s policy adjustments could be the first step toward an exit from its decade-long aggressive monetary easing, according to Takatoshi Ito, a contender to succeed Governor Haruhiko Kuroda.

The shock move on Tuesday to widen the bond yield band is a “positive development” that would improve the functionality of the Japanese government bond market, said Ito, a professor at Columbia University Business School and a close ally of Kuroda.

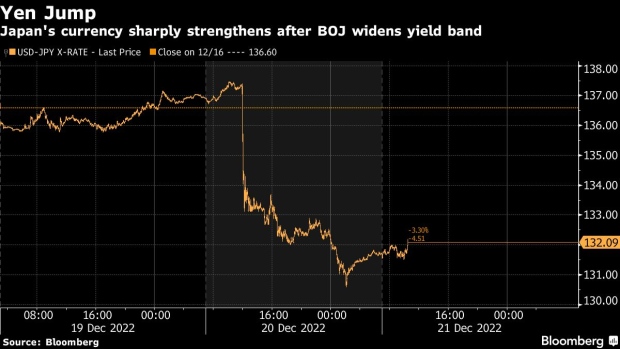

The BOJ modified its yield curve control program by allowing the 10-year JGB yield to rise to around 0.5%, up from the previous upper limit of 0.25%. Kuroda repeatedly denied that the move that triggered a sharp rise in the yield and the yen was a rate hike or a step toward policy normalization.

“That is probably not quite true,” Ito said on Bloomberg TV.

Ito said he sees increasing signs that inflation could stick around above the BOJ’s 2% target, as cost-push factors fuel a positive price mechanism based on higher wages and stronger consumption.

“There’s hope that demand side will be stimulated by a large wage hike, which is a response partly to a high inflation rate this year,” Ito said. “Maybe next year we will see demand pull inflation and stabilize it at 2% and that will be the foundation for the step toward exit.”

Core inflation in Japan is already at 3.6%, with some analysts seeing further acceleration toward the end of the year.

Ito is one possible successor to replace Kuroda when his term ends in April, while other economists see current deputy Masayoshi Amamiya and former deputy Hiroshi Nakaso as top candidates.

©2022 Bloomberg L.P.