Mar 9, 2023

Bolivia’s Central Bank Pledges to Defend Currency Peg as Residents Scramble for Cash

, Bloomberg News

(Bloomberg) -- Bolivia’s central bank moved to reassure anxious savers who have been lining up for days outside the bank’s headquarters in a rush for dollars that has spooked global investors, sinking the nation’s bonds.

“Maintaining a stable currency gives security to the population which allows us to live in a stable economy, in a process of economic recovery,” central bank President Edwin Rojas told reporters in La Paz on Thursday.

Rojas reiterated his commitment to keeping a 15-year old dollar peg in place, and said the monetary authority is adding tellers and fast-tracking administrative processes in a bid to clear out the queues, which have been forming for three days.

The bank began selling dollars directly to the public this week, and across the country via state-controlled Banco Union, to meet a surge in demand.

Outside the building, people were queuing in a line stretching three blocks to buy dollars at the bank’s counters. The scramble was stoked by growing fears the nation’s dwindling cash reserves will force a devaluation of the boliviano currency, which has been held at around seven per dollar since 2008.

The finance ministry’s call on the population last week to cut their demand for dollars further fanned concerns. The monetary authority began selling dollars directly to the public this week, and across the country via state-controlled Banco Union.

The country’s sovereign bonds due in 2028 and 2030 are trading at record lows as concern about the South American nation spreads. Bolivia’s bonds due 2028 fell 0.8 cent to 68.05 cents on the dollar at 2:15 p.m. in New York, according to indicative pricing data collected by Bloomberg.

The longer tenor note fell 5 cents to 82.9 cents on the dollar Thursday, the worst one-day decline since they were issued last year.

The country’s bonds have significantly underperformed peers, handing investors losses of more than 10% this year, only worse than Ecuador and Ukraine, according to a Bloomberg index.

Economic Upheaval

People across Latin America often try to convert their savings into dollars when they are worried about possible economic upheaval.

The central bank has sold $7 million directly to 650 members of the public this week, and transferred $91 million to other banks to help them meet demand, Rojas said.

Hawkers offered to sell plastic chairs and umbrellas to people waiting in line, which have been orderly and without signs of panic. In downtown La Paz, black-market sellers offered greenbacks at an exchange rate of 7.2 bolivianos, higher than the bank’s rate of 6.96, suggesting a growing scarcity of dollars.

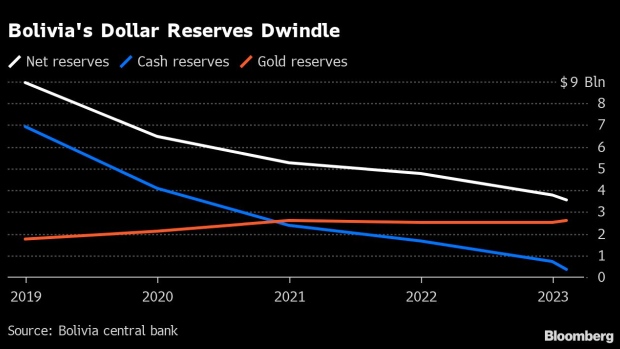

The central bank’s cash reserves slumped nearly 70% to $372 million on Feb. 8, from about $1.2 billion a year earlier. Although the bank still had $3.5 billion in total reserves on that date, most of it is gold which cannot easily be converted into cash without a change in the law.

Prices fell for Bolivia’s natural gas exports when energy prices dropped in 2014 and 2015, which turned the nation’s current account surplus into a deficit. Since then the central bank has propped up the currency by burning through reserves at a pace that wasn’t sustainable. Fitch Ratings and others have been warning for years that the bank’s cushion of reserves was inadequate.

The government ran a fiscal deficit of more than 8% of gross domestic product last year, according to an estimate from the International Monetary Fund.

The central bank hasn’t updated its weekly statistical bulletin since Feb. 17.

- Read More: Bolivian Finance Committee Greenlights Bill to Monetize Gold Reserves

“While liquid reserves are low, the central bank could monetize gold reserves should the assembly pass an outstanding law allowing it to do so,” said Nathalie Marshik, a managing director for Latin America fixed income at BNP Paribas SA, in response to written questions. “Our view is that they buy themselves a little bit of time with the gold reserves, but, barring a reversal in dollar inflows thanks to exports or new concrete financing, the crisis will only escalate.”

After an $183 million bond comes due in August, Bolivia’s next major payment isn’t until 2026, giving the government breathing room.

- Read More: Bolivia’s Wild Year, From Cuba Ally to Trump’s Friend and Back

President Luis Arce, who won the presidency in a landslide in 2020 for the socialist MAS party, helped introduce the currency peg when he was finance minister in 2008.

--With assistance from Maria Elena Vizcaino.

(Updates bond prices in 7th paragraph, adds chart.)

©2023 Bloomberg L.P.