Feb 8, 2023

Bond Investors Are Shrugging Off Surge in Bets on Hawkish Fed

, Bloomberg News

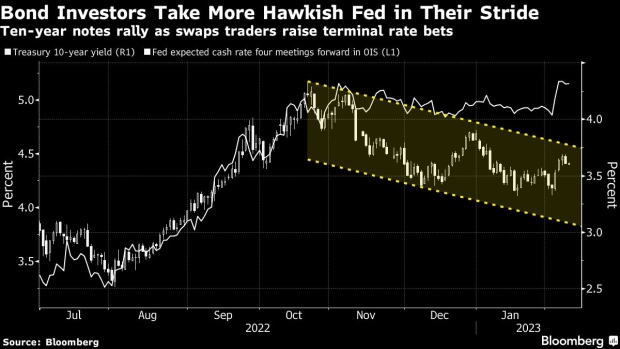

(Bloomberg) -- Investors are piling into the longer end of the Treasuries market even in the face of increased anticipation that the Federal Reserve will remain hawkish enough to substantially hike its benchmark interest rate in the coming months.

The 10-year Treasuries yield held at 3.61% on Thursday after the strongest rally in a week sent it down six basis points on Wednesday. That contrasts with a surge for swap rates, which now see the Fed’s tightening cycle peaking at about 5.15%, a full quarter-point higher than was seen last week. There’s also been a surge in bets the Fed could raise its rate to as high as 6%.

Even as a parade of Fed officials highlighted their willingness to hike rates and keep them elevated, Investors bought a record 95% of Wednesday’s auction of 10-year notes. That underscores the allure of yields above 3.5% — a level unseen for more than a decade until it was breached in 2022 — even amid expectations for higher Fed rates.

“US payrolls last week threw the cat amongst the pigeons, forcing a reset in positioning and thinking on the terminal Fed funds rate,” said Prashant Newnaha, a strategist at TD Securities Inc. “That said, the long end continues to draw strong buying interest. Demand from pension accounts is probably the main driver of this, as well as the first signs that Japanese investors are returning as buyers of foreign fixed income, as weekly fund flows data suggest.”

Retail investors are also returning to bonds after sitting on cash for much of last year’s rout, according to JPMorgan Chase & Co. strategist Nikolaos Panigirtzoglou. The older cohort of such investors, who tend to put their money to work via funds, injected $81 billion into bond funds and $44 billion into equity funds so far this year, the strategist wrote in a note.

“This abrupt change in behavior at the beginning of 2023 is perhaps driven by increased confidence among retail investors that inflation has entered a downward trajectory and that the Fed policy rate is approaching its peak,” Panigirtzoglou wrote.

©2023 Bloomberg L.P.