Oct 19, 2021

Bond Investors Face Year of Peril as Inflation Meets Unwinding

, Bloomberg News

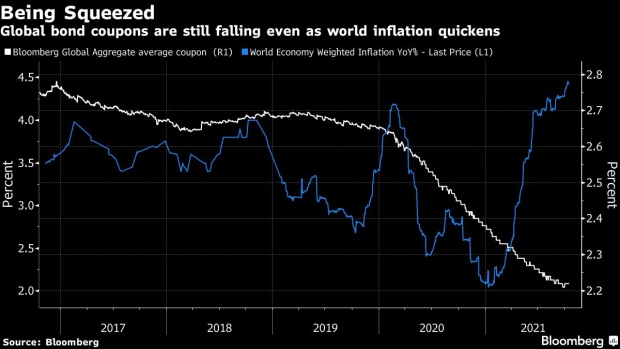

(Bloomberg) -- Global bond investors face an old enemy -- inflation -- and the universe of fixed-income assets is offering precious few places to hide.

U.S. Treasuries, European sovereigns, U.K. gilts and emerging-market credit are all set to lose money over the 12 months through September as dwindling coupons provide little cushion against rising yields, according to forecasts from Bloomberg Intelligence. Adding to the potentially toxic environment for bonds is the prospect of major central banks unwinding debt purchases and raising interest rates.

Government and corporate bonds globally have already lost 4.4% this year, the biggest decline for similar periods since 2005, according to a Bloomberg index.

“The problem now is where is even the income in my fixed income?” said Damian Sassower, chief emerging-markets credit strategist at Bloomberg Intelligence in New York.

Inflation expectations are being driven higher by a spike in energy costs, supply-chain disruptions and the impact of central-bank stimulus. The U.S. 10-year break-even rate, which shows investors’ forecasts for inflation over the period, climbed to 2.57% last week, just a touch below May’s eight-year high of 2.59%. Brent crude has surged to about $85 a barrel, the highest level in three years.

While inflation is eroding the value of bonds’ fixed payments, central banks are pulling back on debt purchases. The Federal Reserve intends to start tapering its $120 billion in monthly asset buying in November or December, according to the minutes of its September meeting published last week.

The Bloomberg Global Aggregate Index, which tracks government and corporate bonds from 24 nations, has dropped 4.4% in 2021, according to data compiled by Bloomberg. On Monday alone, Australia’s 10-year yields jumped nine basis points to 1.74% and similar-maturity U.K. yields climbed as much as seven basis points to 1.17%.

It’s still possible to find some value hidden between different marketplaces with a global perspective, but investors need to be cautious in reaching for yield as “you may get your arm chopped off,” said Lon Erickson, a portfolio manager and managing director of fixed-income strategies at Thornburg Investment Management Inc. in Santa Fe, New Mexico.

Bond king Bill Gross also sees yields rising further. The U.S. 10-year yield will climb to 2% over the next 12 months from the current level of around 1.60%, the former manager of the Pimco Total Return Bond Fund, wrote in an investment outlook last week.

“Markets have likely seen their secular, long term lows in interest rates,” and the outlook for rising yields is “likely to provide a negative sign in front of 2022 total returns for bond holders,” he said.

Still, many people, including Gross have attempted to call an end to the more-than 30-year global bond bull market, only to see the securities resume their rally.

Economists and market participants surveyed by Bloomberg predict U.S. 10-year yields will climb to 1.96% by the end of September and reach 2.04% by December 2022.

Slowing growth in the U.S. together with the largest annual gain in the consumer price index since 2008 have raised concerns about stagflation, which would pummel both bonds and stocks. Citigroup surprise indexes show global inflation expectations are beating expectations by a record, while a similar gauge of growth has dropped in all but one of the past 18 weeks.

Not everyone is negative on the outlook for fixed-income assets.

Bond yields may rise in coming months but they are likely to fall back again due to weak growth and concern about high government debt levels, according to Capitulum Asset Management GmbH.

“If rates spike between now and year-end, you have to buy the dip on bonds,” said Lutz Roehmeyer, chief investment officer at the Berlin-based company. “We will have to live with easy monetary policy for the long term and this keeps me very confident that rates will not rise too high.”

It’s actually a “perfect environment for active bond managers,” said Roehmeyer, whose local-currency and hard-currency emerging-market funds have returned 5% to 6% this year, according to data compiled by Bloomberg.

Chinese government bonds have returned 5.5% in 2021 amid speculation slowing growth in the world’s second-biggest economy will spur the central bank to ease policy further. High-yield corporate debt has also outperformed, cushioned by their generous coupons, with securities in the U.S. making 4.3% this year.

The challenging environment for global bonds means money managers will struggle to deliver positive returns unless they add off-benchmark risk or focus exposure in less-liquid markets, Bloomberg Intelligence’s Sassower said.

“You have to be far more selective, far more nimble, far more flexible and you have to open up your policy constraints to allow yourself to invest in off-benchmark securities where you can get higher yield, with perhaps mis-priced risk,” he said. Just buying a global aggregate bond index for positive returns is “not going to cut it any longer.”

©2021 Bloomberg L.P.