Oct 6, 2022

Bond Market Sees Once Easy Yield-Curve Bets Upended by Fed Path

, Bloomberg News

(Bloomberg) -- Bond traders are losing a sure thing.

As Treasuries were hammered by record losses and whipsawed by volatility this year, there was one wager that traders could count on: that short-term yields would surge until they pushed above long-term ones on speculation that the Federal Reserve’s rate hikes could drive the economy into a recession.

That bet paid off steadily as such fears restrained the upward march of 30-year yields while those on short-dated debt surged. By late September, that pinned 30-year Treasury rates as much as 68 basis points below those on two-year notes, the most since the dot-com collapse in 2000.

But the difference has since narrowed amid speculation that the central bank will stop tightening monetary policy early next year, leaving some investors predicting that the yield-curve inversion trade has largely run its course.

“Looking at periods of deep inversion such as the early 1980s shows they were fleeting and we are closer to the end of rates peaking,” said Richard Familetti, chief investment officer of US total return fixed income at SLC Management.

The shape of the curve is among the most widely watched financial-market barometers because it reflects bondholders’ views of where interest rates and the economy are headed. When the curve inverts, with long yields dropping below short ones, it signals expectations of a slowdown that will drive rates lower in the future.

That happened in the middle of this year as the Fed enacted its most aggressive tightening moves in decades in the face of persistently elevated inflation. The 10-year yield slipped below the 2-year rate in early July, with the 30-year following suit. Those sections of the curve are now inverted by about 40 basis points, narrowing from the levels seen in late September.

Some investors say that could reverse and deliver another round of profits for those betting that long-term debt will outperform. With the Fed poised to keep raising rates through the rest of the year and officials sticking to a hawkish tone, short-term rates are likely to stay elevated. But longer-maturity bonds may gain, driving down yields, if investors grow fearful that elevated rates will stifle the economy.

“We still have the flattener on and it’s in the back end, 20-years and longer,” said Mark Lindbloom at Western Asset Management. “A more prolonged period of inversion will occur if the Fed keeps at it. The Fed does not know -- and we don’t know -- how far they will tighten.”

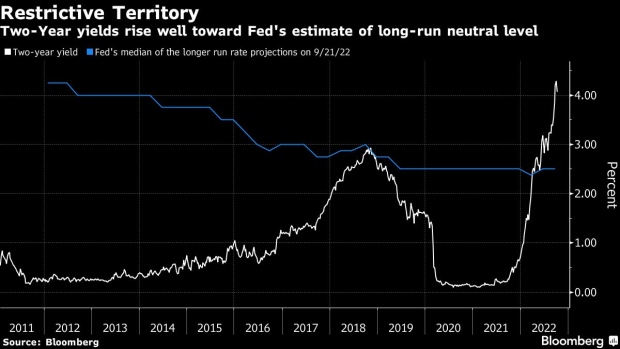

Yet short-term yields may pose a limit to how much wider the gap can grow. Two-year Treasury yields have jumped more than fivefold so far this year and now stand around 4.2%. With markets pricing in that the Fed’s key rate will peak around 4.5%, it’s unlikely those yields will rise much more unless stronger-than-expected inflation figures drive the market to raise its estimate for where that rate will crest.

The uncertainty facing the economic outlook is making bets on the direction of the yield curve far more difficult than they were earlier this year, when the market rapidly priced in the Fed’s hawkish shift.

“We are not sure where the cycle will be at the end of the day,” said Antoine Bouvet, senior rates strategist at ING Groep NV. “There’s no limit to how inverted the curve can be,” and while he does not rule out the two-year yield rising to 1 percentage point above the 10-year, he added: “I don’t want to chase the move from here. As a new trade, I am not convinced this is a good entry level.”

That could change if inflation unexpectedly accelerates or the job market is resistant to the Fed’s efforts to cool it down. For now, forecasters are predicting that Friday’s job report will show that payroll and wage growth slowed in September.

“The Fed’s terminal rate has been priced nicely at 4.5%,” said Ed Al-Hussainy, a rates strategist at Columbia Threadneedle Investments, who removed his recommendation for the flattening trade a couple of weeks ago. “It’s not clear that the curve should flatten further, unless there are a lot of inflation surprises on the upside.”

©2022 Bloomberg L.P.