Jun 17, 2019

Bond Rally Has Legs for Top Fund Betting on Looser RBA Policy

, Bloomberg News

(Bloomberg) -- When one of Australia’s best performing fixed-income funds started betting last year the central bank would cut interest rates, very few others were on board.

Now, despite it being a more consensus trade and with yields at all-time lows, they still reckon there’s more life in the bond rally.

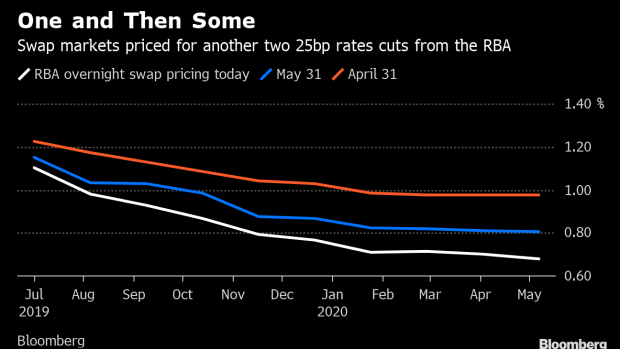

“Until we actually get the second rate cut, that’s probably when we’ll start to review how we’re positioned,” said Darren Langer, head of Australian fixed-income at Nikko Asset Management Co., who spent most of the past 25 years managing bond portfolios.

The firm is keeping an overweight position to three-year debt, expecting that yields could fall by 50 basis points if the Reserve Bank of Australia cuts for a second time this year. Still, for his Australian bond fund which returned 9.8% in the past year and beat 96% of peers, similar returns will be harder to come by, he said.

The yield on Australia’s three-year bonds dipped to 0.98% last week as the jobless rate failed to improve in May. Language in next month’s RBA decision may be key, as some strategists argue market levels already reflect further easing.

“You’d have to see things get a lot worse to have another eight or nine percent return,” Langer said in the interview last week in Melbourne.

Here are some other notable observations from the interview with Langer and colleague Chris Rands:

- Nikko has been wading into New South Wales state and Victorian state bonds as they’ve been “beaten up” on fears their budgets will be impacted by the slumping housing market

- The managers also like bonds with more than seven years in duration as “anything with a yield suddenly becomes attractive” in a low cash environment

- The fund also likes short-dated corporate debt as while the RBA won’t kick the economy into life, it’ll prolong the economic cycle

- Keep an eye on Chinese domestic demand that’s been weighing global trade for a guide as to whether Australia will tip into recession, they said. The surge in iron ore prices has offset the drop in house prices, however Chinese indicators are not picking up, they observed

--With assistance from Stephen Spratt.

To contact the reporter on this story: Matthew Burgess in Melbourne at mburgess46@bloomberg.net

To contact the editors responsible for this story: Edward Johnson at ejohnson28@bloomberg.net, Adam Haigh, Liau Y-Sing

©2019 Bloomberg L.P.