Jun 19, 2021

Bond Sales to Dwindle as U.S. Summer Lull Begins

, Bloomberg News

(Bloomberg) -- New high-grade bond sales are expected to slow next week as the U.S. summer lull starts to kick in, with syndicate desks calling for just $15 billion to $20 billion of fresh supply.

Eyes will be on Treasury yields following a turbocharged flattening of the curve this week as traders brought forward expectations for when the Federal Reserve will start raising rates. Increasing confidence that Fed tightening will help check inflation weighed on the long-end Friday, sending the 30-year yield to a level not seen since February.

“This could lead to some opportunistic 30-year issuance” from high-grade companies, said Travis King, head of U.S. investment-grade corporates at Voya Investment Management.

Yet lower yields are also likely to curb demand for long-dated corporates.

“While technicals remain strong, a decline in long-dated yields should negatively affect demand from insurers and pension funds, potentially weighing on long-dated investment-grade spreads,” Barclays Plc strategists led by Bradley Rogoff wrote Friday.

Next week’s high-grade deal flow is anticipated to be a mix between corporates and financials.

High Yield

The speculative-grade pipeline is relatively quiet heading into the week.

At Home Group Inc. kicks off a roadshow Monday for a two-part bond sale that backs Hellman & Friedman’s buyout of the firm. The deal is made up of a $300 million secured portion and a $500 million unsecured tranche. The Interior decorating company is also scheduled to wrap up a $600 million loan offering Thursday.

Firearm accessories maker Magpul Industries Corp. continues to market its inaugural high-yield bond, a $300 million note that will be used to refinance debt and pay a special holder dividend. The company, which is owned by private investment firm Albion River, is sounding out investors at a yield of around 5.5%.

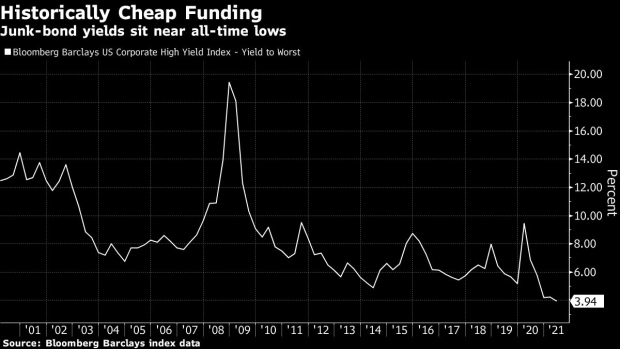

The refinancing wave is likely to remain a driver of U.S. junk-bond issuance after yields reached a fresh record low this week, before rebounding slightly.

In distressed credit, Ronald Perelman’s Vericast Corp. is closing in on a new deal that would see the company exchange some borrowings and issue new debt to rework its capital structure. The exchange, led by Chatham Asset Management, could be launched in the coming days after a failed attempt earlier this year.

And GTT Communications Inc.’s latest forbearance deadline was extended again, to June 28.

©2021 Bloomberg L.P.