Jun 29, 2022

Bond Traders Bet Market Has Swung Too Far on Korea Rate Hikes

, Bloomberg News

(Bloomberg) -- Valuations are starting to turn attractive for South Korea bonds amid signs the market has overpriced how much the most hawkish central bank in emerging Asia may raise rates.

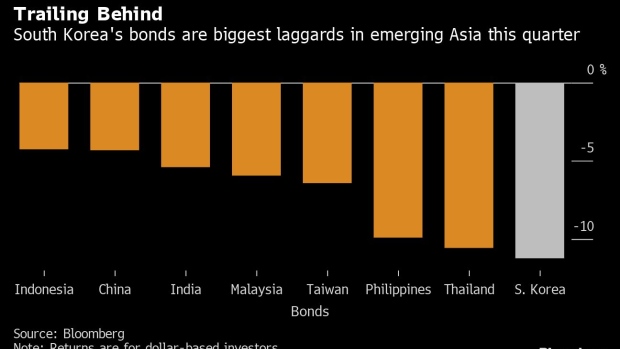

Won forward rates are pricing in about 125 basis points of hikes over the next six months, far above economists’ forecasts for how much the Bank of Korea will move. This points to an improving environment for won bonds, the biggest loser among emerging-Asia’s sovereign debt this quarter as inflation quickened to a 14-year high and bets on rate increases jumped.

Increased flows into Korean debt may help ease pressures on the won, which last week reached a 13-year low. The country is vulnerable to soaring imports exacerbated by a weak currency. It also means that Korean bonds may start to diverge from other emerging markets in Asia, where the risk of interest-rate swaps and yields moving higher is clouding the outlook.

“We see value in Korean government bonds, as the market pricing of the policy rate hikes looks excessive at 25 basis points per meeting for the rest of the year, and as supply dynamics will turn somewhat more favorable in the second half,” said Jin Yang Lee, an investment manager for sovereign debt at abrdn in Singapore.

Read: Traders Price In First Ever 50 Basis-Point Hike by South Korea

Foreign flows into Korean rates were the lowest this quarter since the last three months of 2020, at $15.7 billion, according to data as of June 29.

While the Bank of Korea has increased rates by 125 basis points since last year, the most among major Asian central banks, policy makers in Thailand and Indonesia are keeping benchmarks at record lows, and Bank Negara Malaysia has only hiked by 25 basis points.

More hawkish bets for the BOK have not only dragged on won bonds but pushed up interest-rate swaps in recent weeks. Korean won two-year non-deliverable interest-rate swaps rose to the highest in more than a decade this month, as did five-year swaps.

Goldman Sachs Group Inc. is calling for a receiver on the two-year swaps, which would profit when rates decline, saying in a note Friday that they’ve overpriced rate hike expectations. The US bank paired this trade with a pay on equivalent Hong Kong dollar swaps as it seeks to hedge some global rate volatility.

Citigroup Inc. said in a research note last week that it’s positioning for South Korea’s expected rate trajectory to be overtaken by the US in the months ahead. In contrast, it’s underweight duration in most Southeast Asian notes.

©2022 Bloomberg L.P.