Apr 1, 2023

Bond Traders Eye More Gains After Volatile But Lucrative Quarter

, Bloomberg News

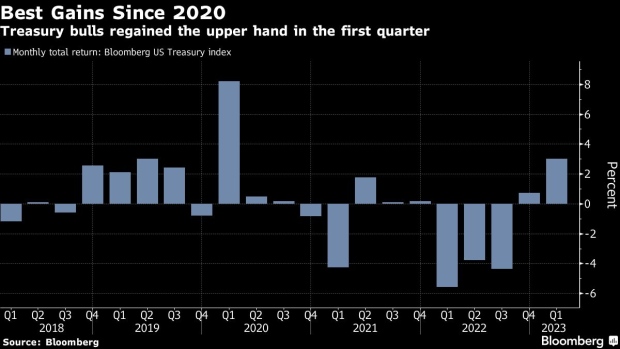

(Bloomberg) -- Treasuries are coming off one of the most turbulent quarters in years with the best returns since 2020 and there are reasons to expect more gains are in store.

There are at least three significant forces lining up in the bond market’s favor in the near term: the potential for increased purchases by investors in Japan at the start of their fiscal year; a weeklong hiatus in note and bond auctions; and flows into US government bond funds have been on a tear.

That doesn’t mean it will be a one-way market, though. There’s a risk that the monthly US jobs report next Friday will provide a jolt if it comes in stronger than expected and reignites expectations for an additional interest-rate hike by the Federal Reserve in May. And coming during a holiday-shortened trading session, there’s a possibility its impact will be outsized.

The labor-market report, of course, could equally help cement expectations that have evolved in the wake of recent banking turmoil about the next Fed rate move needing to be a cut — a situation that could also support appetite for Treasuries.

The mere prospect of monetary policy easing this year should keep downward pressure on yields even if the rally is temporarily exhausted, said Steve Bartolini, a portfolio manager at T. Rowe Price. “We know if a recession comes they will cut aggressively — that’s what they do,” Bartolini said.

In the meantime, the various tailwinds within the Treasury market itself could also keep downward pressure on yields.

Flows into US government bond funds have totaled $43 billion in the last eight weeks, according to TD Securities.

The coming week’s Treasury auction slate is confined to bills, with the next coupon-bearing sale not coming until April 11, when three-year debt is on offer.

And Japanese Ministry of Finance data show an increase in buying of foreign bonds beginning in February. “This should serve — though not in a vacuum — as an additional source of demand,” said BMO Capital Markets strategist Benjamin Jeffery.

A Momentous Quarter

Treasuries 3% return in the first quarter — the biggest since the first three months of 2020 when the onset of the Covid pandemic sparked a flight into haven assets — came about as the first US bank failures since 2008 sparked a reassessment of the likelihood of additional Fed rate increases, despite still-elevated inflation readings.

Yields for Treasuries across most maturities reached their lowest levels of the year in March, led by shorter-dated securities. The journey was also rocky, with the two-year yield rising or falling at least 20 basis points on nine different days.

A broad measure of Treasury volatility, the ICE BofA MOVE Index, reached its highest level since the 2008 financial crisis, while a gauge of two-year yield volatility climbed to a record using 40 years of data, according to Bloomberg Intelligence.

Bond yields were weighed down Friday after a cooler-than-anticipated reading on one of the Fed’s key inflation gauges, but still ended off their extreme lows from earlier in the month amid signs that the crisis in the American banking system has been contained to some degree.

By the end of Friday, traders were assigning a little more than a one-in-two chance of another quarter-point Fed rate increase in May. That’s up from up from near zero odds the week before, but a marked shift from the hawkish rate-hiking picture painted before Silicon Valley Bank’s collapse sent markets reeling. And more notably, there is a solid conviction that officials will be cutting before the year is out, even if they do boost one more time.

All eyes now are on whether the Fed will signal plans to push on with tightening, and whether both economic data and financial conditions will support that or not.

Lisa Cook, Loretta Mester and James Bullard are among Fed officials slated to speak in the coming week. And from the banking side, new data on lending could provide insight into whether the recent crisis is spilling over into real activity — something the following week’s quarterly survey of senior loan officers could also shed light on.

“We are not going to see the extent of tighter lending from banks for a number of weeks and possibly quarters,” said Roger Hallam, global head of rates at Vanguard Asset Management.

What to Watch

- Economic data calendar:

- April 3: S&P Global US manufacturing purchasing managers’ index; construction spending; Institute for Supply Management manufacturing index; vehicle sales

- April 4: Factory, durable goods and capital goods orders; JOLTS job openings

- April 5: MBA mortgage applications; ADP employment change; trade balance; S&P Global US services PMI; ISM services index

- April 6: Weekly jobless claims; Challenger job cuts

- April 7: US monthly jobs report

- Fed calendar:

- April 3: Governor Cook

- April 4: Cleveland Fed’s Mester; Cook

- April 6: St. Louis Fed’s Bullard

- Auction calendar:

- April 3: 13- and 26-week bills

- April 5: 17-week bills

- April 6: 4- and 8-week bills

©2023 Bloomberg L.P.