Apr 12, 2022

Bonds Extend Rout as Traders Crank Up Bets on Bigger Rate Hikes

, Bloomberg News

(Bloomberg) -- The relentless selloff in Treasuries is stretching into an eighth day as traders speculate that a hotter inflation print will push the Federal Reserve into more aggressive tightening.

Benchmark 10-year yields rose to 2.83%, the highest since December 2018. The rout swept across global bond markets, with European and Japanese yields also climbing higher.

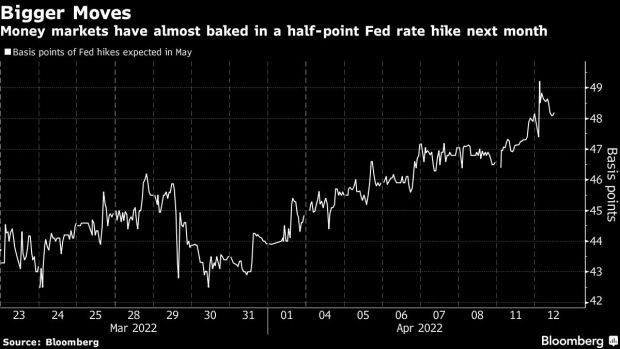

All eyes are on the U.S. consumer price data due Tuesday, with economists forecasting an 8.4% annual gain in March’s index, a fresh four-decade high, and many traders speculating that the print will likely be even higher. They’re pricing bigger rate hike expectations, and money markets show bets for a 48 basis-point increase in May.

Some investors are starting to contemplate the possibility of markets moving even further to price in a single 75-basis-point hike.

“I think if we get a large beat in U.S. CPI, then the market will start to price in that possibility, especially if core is strong,” said Peter McCallum, a rates strategist at Mizuho International Plc. He added that his own view is that money markets will hold around the 50 basis-point mark.

A Bloomberg gauge measuring total returns in Treasuries has slumped almost 8% this year, on track for its worst annual decline since at least 1973, as rate-hike bets gather pace.

“The market’s been slow in recognizing inflation is truly out of the bottle and we’re all catching up now,” said Stephen Miller, investment consultant at GSFM, a unit of Canada’s CI Financial Corp. He thinks 10-year yields could eventually test 3.5%.

©2022 Bloomberg L.P.