Jun 6, 2023

Bonds of Billionaire’s Mexican Cable Company Rally

, Bloomberg News

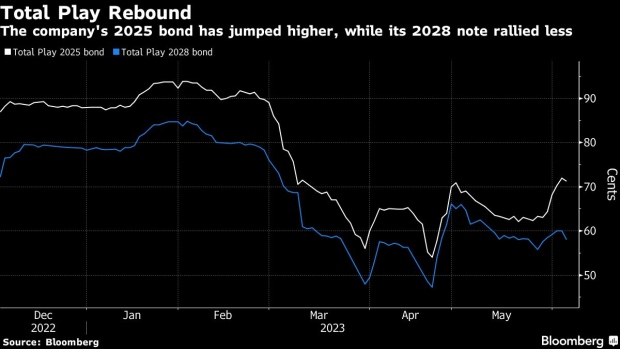

(Bloomberg) -- Bonds of Total Play Telecomunicaciones SA, the cable and internet provider owned by billionaire Ricardo Salinas, have staged a turnaround on signs of fresh financing and a cost-cutting plan that should free up cash for debt payments.

Notes due 2025 have jumped more than 6 cents on the dollar over the past week to around 71 cents, making them the top-performing bonds in Latin America this month, according to a Bloomberg index. Bonds due in 2028 are up 0.5 cents on the dollar to 58 cents over the same period.

Investors are betting Total Play can finalize a loan ahead of short-term maturities and bring down the pace of capital expenditures to keep up with its debt obligations. It marks a bit of relief for Salinas, a retail and media magnate worth an estimated $13.9 billion, after another of his companies, broadcaster TV Azteca SAB, defaulted on bond payments in 2021.

“The loan is the most important short-term hurdle that needs to be overcome,” said Alexis Panton, an emerging markets strategist at BNP Paribas in New York. “However, we think there are also additional levers the company can pull, principally through lower than expected capex.”

Financial news outlet REDD Intelligence reported late last week Total Play was close to securing the loan, for as much as $300 million, though at a higher interest rate than management had previously suggested. The company had said earlier this year it expected to close the loan by April and then pushed the timeline back to the end of May in its first quarter conference call in April.

A spokesperson for Total Play didn’t answer emailed questions from Bloomberg News about the status and terms of the loan and said recent reporting on the company has created speculation aimed at damaging Total Play and Salinas’s reputation.

“Total Play is a completely independent company from TV Azteca, so the circumstances of both companies are unrelated,” the Total Play representative said in an email.

The company had previously signaled it is pivoting after spending heavily to build out its fiber optic network and challenge the country’s other three cable and internet providers. Total Play said during its conference call on April 28 that it was trimming its capital expenditure target for this year to 14 billion pesos ($800 million) from previous guidance of 15 billion to 17 billion peso range.

BNP’s Panton said Total Play could further cut costs and that its balance sheet will be bolstered by the performance of the Mexican peso, one of the best performing currencies in the world this year.

“We think the market is overlooking the fact that the company is below three times leverage on a run-rate basis, is a significant beneficiary of the stronger peso, and that the vast majority of its multihundred million dollar capex budget is potentially discretionary,” he said.

--With assistance from Maria Elena Vizcaino.

(Adds 2028 bond move in paragraph two and company comment in paragraph seven. A previous version corrected the date of default in third paragraph.)

©2023 Bloomberg L.P.