May 24, 2022

Bostic Urges Fed Tighten Policy With Care, Avoid ‘Recklessness’

, Bloomberg News

(Bloomberg) -- Federal Reserve Bank of Atlanta President Raphael Bostic, who’s one of the US central bank’s dovish policy makers as they confront surging inflation, urged his colleagues to proceed with care.

“As we expeditiously return monetary policy to a more neutral stance to get inflation closer to our 2% target, I plan to proceed with intention and without recklessness,” he wrote in an essay published by his bank on Tuesday. “We have seen throughout the pandemic that events and market shifts can happen quickly.”

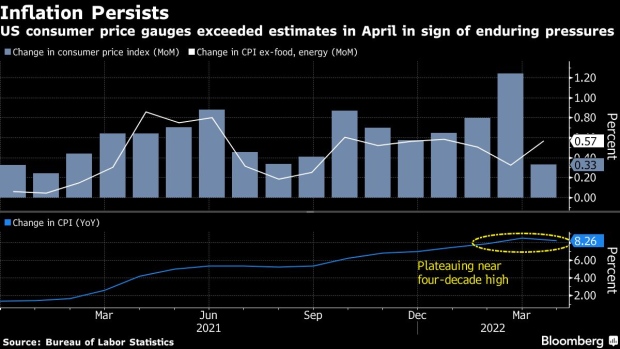

The Fed raised interest rates by 50 basis points earlier this month and Chair Jerome Powell signaled it was on track to make similar-sized moves at its meetings in June and July, a plan that both hawks and doves on the policy-setting Federal Open Market Committee have since embraced to cool the hottest inflation since the 1980s.

The pivot to tighter policy has contributed to sharp swings in financial markets as investors fret the Fed could trigger a recession by acting too aggressively, even as higher prices pressure corporate profit margins.

Powell said on May 17 that officials want to see “clear and convincing” evidence that inflation is in retreat in order to stop pushing on policy. Bostic agreed that tamping down price pressures was the top priority, but argued that it was risky to place too much faith in forecasts.

“Uncertainties shroud the economic outlook on virtually every front, from the pandemic to war in Ukraine to supply constraints,” he said. “Policy makers must be mindful of those uncertainties and proceed carefully in tightening policy.”

Bostic, who does not vote on policy this year, has argued for a possible pause when officials meet in September to review the impact of their actions on the real economy. He didn’t repeat that message in his essay but did stress the need for flexibility.

“We all must be ready for the unexpected to occur, assess how risks have changed when it does, and stay aware of shifts in the strength of the economy,” he said. “Even firetrucks with sirens blaring slow down at intersections lest they cause further preventable trouble.”

(Updates with more Bostic comment in final paragraph.)

©2022 Bloomberg L.P.