Apr 20, 2020

Bottom-calling bets on US$4.3 billion ETF go bad amid oil plunge

, Bloomberg News

Industry needs 'meaningfully larger' aid package than what the government has offered: Enerplus CEO

Historic turmoil in the oil market is proving painful for investors who just piled into a US$4.3 billion energy ETF.

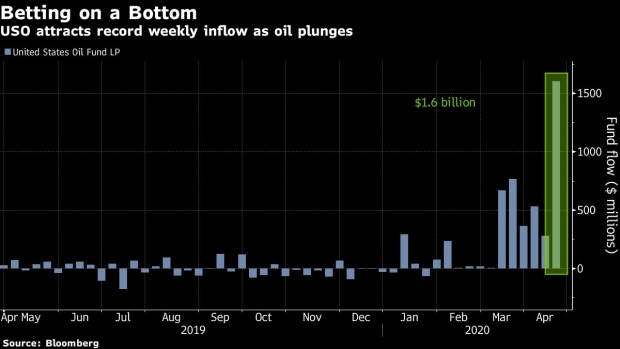

The United States Oil Fund LP, or USO, plunged as much as 11 per cent to hit the lowest since its 2006 inception amid a sell-off in crude. USO’s slide came after investors plowed US$1.6 billion into the exchange-traded fund last week -- the best on record.

USO is a popular choice for retail investors looking to bet on short-term price reversals, buying dips and selling rallies. However, those bets soured Monday. Crude plunged as a deadly pandemic ravaging global economies threatens to erase an entire decade of demand growth, slashing thousands of jobs and wiping out hundreds of billions of dollars from company valuations.

“Traditionally, this product is used to play mean reversion. It also attracts outsiders whenever oil is so low it makes the nightly news,” said Eric Balchunas, an analyst at Bloomberg Intelligence. “So it’s basically an overcrowded bottom-calling trade gone bad.”

State Street’s US$8.6 billion Energy Select Sector SPDR Fund, ticker XLE, dropped as much as 6.4 per cent before paring losses. Meanwhile, US$2.6 billion Vanguard Energy ETF, ticker VDE, sank more than 6 per cent before recovering from its lows.

Before Monday’s rout, traders poured money into USO as demand to bet against further declines faded. Short interest as a percentage of shares outstanding on USO -- a rough indicator of bearish bets on the fund -- is currently 0.83 per cent, according to data from IHS Markit Ltd. That’s down from 5.9 per cent on March 12.

USO said last week that it will move 20 per cent of its contracts from the nearest month to the second-traded month. The issuer cited market and regulatory conditions in announcing the shift as coronavirus-related fears open up a gap between plunging prices for the nearest dates and the following month.

West Texas Intermediate dropped to the weakest level since 1986. The plunge was exaggerated as the May futures contract expires on Tuesday. The June contract fell to around US$23 a barrel.