May 25, 2023

Brahman Closes Hedge Fund After More Than Three Decades

, Bloomberg News

(Bloomberg) -- Brahman Capital Corp. is shuttering its stock-picking hedge fund and returning cash to clients after more than three decades, according to people familiar with the matter.

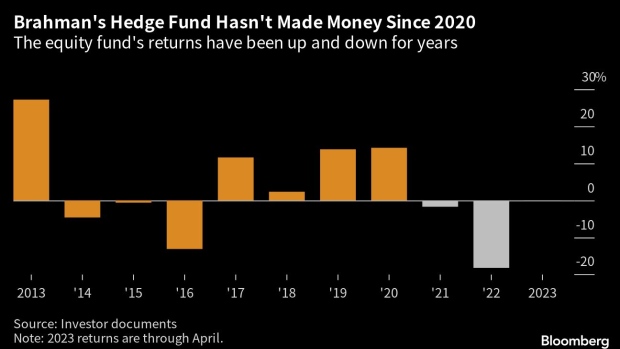

The fund has lost money the last two years — including an 18% decline in 2022 — and has been flat this year through April, according to documents seen by Bloomberg.

Brahman, which manages $1.1 billion, is returning less than half of those assets as part of the hedge fund closing. Clients will get most of their capital back by mid-June.

The firm will continue running its long-only fund to capitalize on market dislocations, one of the people said. That fund is up 3.1% this year through April, trailing the S&P 500’s 8.6% gain.

A spokesman for the New York-based firm declined to comment.

Stock-pickers have benefited from a stronger market this year, compared with the tech rout of 2022 when the S&P benchmark tumbled 19%. The number of hedge fund closures last year topped new funds — in a reversal from 2021.

Brahman’s hedge fund has returned an annualized 8% since it started trading in 1991. Firm assets have tumbled from $5.5 billion at the end of 2015.

Brahman runs a concentrated portfolio. It was invested in 20 stocks as of March 31, and four of those accounted for almost 60% of its long equity exposure, regulatory filings show. Three of those four have lost money this year.

Mitchell Kuflik, Robert Sobel and Peter Hochfelder founded Brahman in 1989, naming it after a “bull that has evolved to thrive during feast and famine,” according to the firm’s website.

--With assistance from Heather Perlberg.

©2023 Bloomberg L.P.