Oct 2, 2022

Brazil Assets Set to Outperform as Lula, Bolsonaro Go to Runoff

, Bloomberg News

(Bloomberg) -- Brazilian assets outperformed on Monday after investors welcomed the closer-than-forecast results of the first round of presidential voting.

The real was up as much as 5% against the dollar, the biggest one-day jump in more than four years, while swap rates fell throughout the curve, with long-end contracts down falling as much as 33 basis points. The benchmark Ibovespa equity index rallied 5.5% for its best session since April 2020. The nation’s sovereign dollar bonds and five-year credit default swaps were among the best performers in emerging markets.

Investors are betting the leftist former President Luiz Inacio Lula da Silva’s narrow lead may pressure him to pivot toward the center before the second-round vote and prioritize market-friendly policies. Meanwhile, the incumbent Jair Bolsonaro’s better-than-expected showing suggests he still has a chance to win in the second round, potentially providing continuity for investors.

The “results signal that if Bolsonaro wins, the reform agenda will continue,” said Luiz Fernando Figueiredo, a former central bank director and partner at Maua Capital. “But if Lula wins, it should be a more pragmatic government, which should be positive for investors.”

Brazil’s presidential contest will now go to a runoff Oct. 30 after no candidate received at least 50% of the vote. Lula got 48% on Sunday, compared with 43% for Bolsonaro. Some polls had shown Lula, a former union chief who led the country from 2003 through 2010, set to win a majority in the first round.

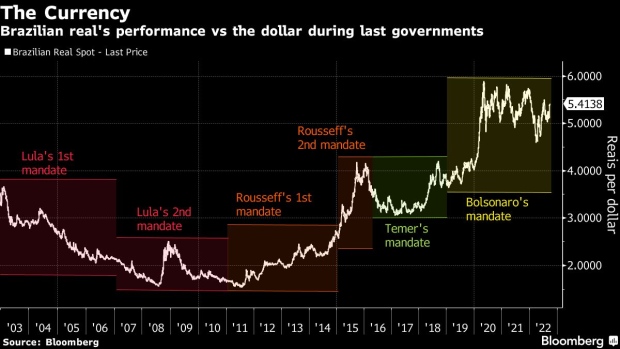

Brazilian markets remained relatively calm in the run-up to this year’s vote, based on expectations that neither of the two top candidates would undermine the country’s finances in the short term. The Brazilian real is the best-performing major currency this year, while the Ibovespa equity index is largely outperforming a sharp drop for the MSCI All Country World Index.

While investors don’t anticipate disruption in Brazil’s macroeconomic policy, Lula and Bolsonaro, a former military officer, diverge on themes that vary from protecting the environment to the role of the state in Latin America’s largest economy. Lula has been more vocal about using state-run companies to help boost economic activity, while Bolsonaro signaled plans to continue moves toward privatization.

Shares in state-controlled companies gained Monday on the back of the stronger-than-expected support for Bolsonaro. Sabesp shares climbed as much as 21% after Tarcisio de Freitas secured a surprising lead in the Sao Paulo governor race. Freitas has previously suggested support to eventually privatize the water utility controlled by Sao Paulo state. Traders will now rush to price higher odds of a privatization.

Here’s what money managers and analysts are saying:

- Edwin Gutierrez, the head of emerging-market sovereign debt at abrdn in London:

- “Bolsonaro still has a chance, but this is still Lula’s election to win. But more importantly, Congress definitely broke far more for the right than expected. With right-wing parties being a bigger block than expected, this will definitely handcuff Lula’s tax and spend agenda”

- “The margin of victory in the runoff should still be wide enough to ‘disprove’ any fraud alleged by Bolsonaro. That said, this is not a dead cert, so this risk remains non-zero”

- Thierry Wizman, a currency and interest-rate strategist at Macquarie Capital in New York:

- “The market may applaud the prospect that even if Lula wins the second round on Oct. 30, he is unlikely to have as much support in Congress and among the governors as he would have liked. This means that his administration may lean more moderate”

- “But with much of the world entering recession and commodity prices set to define further, it is difficult to stay optimistic. And attention should shift to the condition of the global economy and Brazil’s terms of trade, which will get worse. For this reason, I would use a rally to reduce exposure to Brazil”

- Natalia Gurushina, an emerging markets fixed-income economist at Van Eck Associates Corp:

- “The first-round results are more market-friendly than the pre-election polls suggested. The margin is very slim, and this means that the uncertainty about the presidential election outcome will persist until the very last moment. Brazil’s improving fundamentals -- especially disinflation and a somewhat better growth outlook -- can boost Bolsonaro’s chances.”

- Malcolm Dorson, a portfolio manager at Mirae Asset Global Investments in New York:

- “A tighter-than-expected race may have Lula giving more color on his economic team and potentially his pick to head the Finance Ministry. He hasn’t had to do yet because he’s had such a lead. A close race should incentivize him to be more transparent. Markets should like it.”

- Jared Lou, a portfolio manager at William Blair Investment Management LLC:

- “Although we expected the polls to under-represent the Bolsonaro vote, this is a tighter race than we thought it would be. Lula will have to work harder to attract the center. This also implies that if Lula does eventually win, we won’t have as strong of a mandate as many had thought he would have”

- “Ultimately, this bodes well for Brazilian assets. Although the market was pricing in a Lula victory, the probability of a radical left leaning government has decreased. What would be best for Brazilian risky assets is policy continuity”

- Katrina Butt, a senior Latin America Economist at AllianceBernstein in New York:

- “As results were closer than most polls ahead of the first-round vote were indicating, Brazilian assets should rally. However, there’s still significant uncertainty going into the second round, including a tail risk of social unrest and calls of election fraud if Bolsonaro loses in the runoff”

- Jeff Grills, head of emerging markets debt at Aegon Asset Management in Chicago:

- “There might be a brief relief rally, but Brazilian assets will be mostly influenced by global markets. The market focus will now shift to the polls again and how expectations evolve between Lula and Bolsonaro”

- “Markets will be hoping for more signs of a pause in the hiking cycle by developed-market central banks, which I don’t believe they will get, so risk assets are likely to remain vulnerable”

- Dario Valdizan, head of buy-side research at Credicorp Capital Asset Management in Lima:

- Tighter-than-expected race “should translate into a more constructive view for the country”

- Lula “will need to provide more clarity regarding social expenditure, fiscal discipline, and the role of the BNDES and state-run firms”

- Gustavo Pessoa, a founding partner at hedge fund operator Legacy Capital in Sao Paulo:

- Brazilian assets should react positively as Lula will need to move toward the center and signal a more moderate plan, possibly tapping former central bank chief Henrique Meirelles for his economic team

- Edward Moya, senior market analyst at Oanda:

- “Markets were pricing in a decisive Lula victory and now it seems Bolsonaro could pull off a re-election, which should give a modest boost to the Brazilian assets”

- Alberto Ramos, chief Latin American economist at Goldman Sachs Group Inc:

- “Brazilian assets are expected to open (slightly) up given the likelihood of a more competitive race. Key for market direction and asset prices will be the post first-round runoff polls”

- “We are bound for a competitive and likely also very polarized presidential election runoff”

- Andres Abadia, chief Latin America economist at Pantheon Macroeconomics:

- “The key issue now is how the center and center-left of the political spectrum will position themselves in the second round”

- “In markets, we think external conditions will remain the key near-term driver, as the race is very tight”

- “The good news is that Brazilian markets have performed relatively well in recent months, despite the presidential race, suggesting that both candidates are considered business- and market-friendly”

(Updates with Ibovespa’s close in second paragraph.)

©2022 Bloomberg L.P.