Apr 13, 2021

Brazil Central Bank Pledges to Stop Core Inflation Contagion

, Bloomberg News

(Bloomberg) -- Brazil’s central bank is closely monitoring if a recent spike in commodity prices will continue to affect core inflation, and particularly expectations for 2022, as it calibrates monetary policy, according to its President Roberto Campos Neto.

The bank delivered an outsized rate hike last month and promised another in May as it realized that what it deems as temporary price shocks were having a more lasting impact on inflation, even when excluding more volatile items such as food and energy.

“We understand that this process had some contamination in the core inflation numbers,” Campos Neto, 51, said in a Bloomberg TV interview late on Tuesday. “We keep vigilant on how this process is developing.”

Brazil’s central bank is trying to put a lid on accelerating inflation without suffocating the recovery of Latin America’s largest economy. It’s an especially delicate balance to strike as the nation reels from one of the world’s worst Covid death tolls and partial lockdowns. At the same time, investors are fretting over faster spending and populist inclinations of President Jair Bolsonaro.

Read More: Probe Into Bolsonaro’s Handling of Pandemic Adds to Market Woes

“We need to move rates but still be on stimulatory grounds,” Campos Neto said during the interview, without ruling out bigger interest rate hikes. “Nothing is written in stone.”

His ability to balance both challenges could define his career at the helm of the monetary authority. Since taking over the post in 2019, the former Banco Santander SA executive oversaw deep cuts to borrowing costs aimed at propelling Brazil out of a virus-driven downturn.

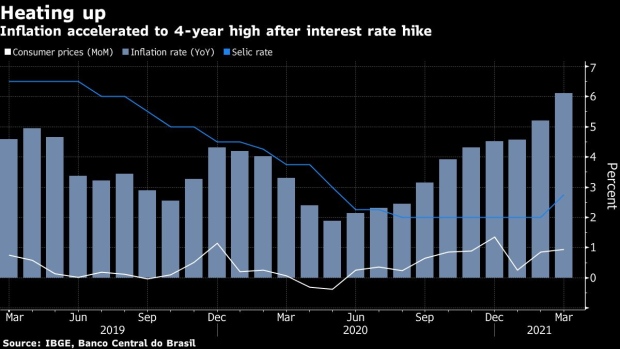

But with annual inflation currently at a four-year high of 6.10%, well above this year’s 3.75% target, concern has shifted to the eroding purchasing power of Brazilians. According to the country’s statistics institute, surging transportation costs are a primary cause for the jump with fuel prices rising over 11% last month alone.

In effort ease the inflationary pain, policy makers raised rates by 0.75 percentage point in March -- the most in a decade -- and signaled another hike of the same magnitude is coming in May, taking the Selic rate to 3.5%.

Many investors believe more aggressive hikes are needed to get inflation under control. Traders in interest rate futures are betting that policy makers will lift borrowing costs to over 6% by year’s end, while economists surveyed by the bank see borrowing costs at 5.25% in December.

Fiscal Concern

But Campos Neto said the swap market is being affected by doubts over Brazil’s commitment to get public finances in order. “We believe fiscal is imposing a premium on the curve, and this premium contaminates expectation that ends up in inflation,” he said.

Under pressure from political allies amid a devastating pandemic, Bolsonaro has broken past commitments to rein in public spending and adopted a more interventionist stance toward state-owned companies. In February, he ousted the head of state oil giant Petrobras for allowing fuel costs to rise according to international market prices.

Meanwhile, the government continues to dole out more emergency aid as new and more lethal wave of the virus persists. Brazil broke daily records for Covid deaths twice last week, and hospitals nationwide are at capacity with patients sickened by the disease.

BRAZIL INSIGHT: Track the Second Wave - High-Frequency Dashboard

While Campos Neto insisted the central bank has no say in fiscal policy, he made it clear that confidence in Brazil’s public finances will be crucial to the future of interest rates.

“We think it is very important to pass on a message of fiscal discipline,” he said.

(Updates with Campos Netos quotes, fuel price increases, context throughout.)

©2021 Bloomberg L.P.