Mar 30, 2023

Brazil Central Bank Sees Economy Growing Faster Than Forcast

, Bloomberg News

(Bloomberg) -- Brazil’s central bank expects the economy to grow at a faster pace than most analysts predict this year even as it holds interest rates steady at a six-year high.

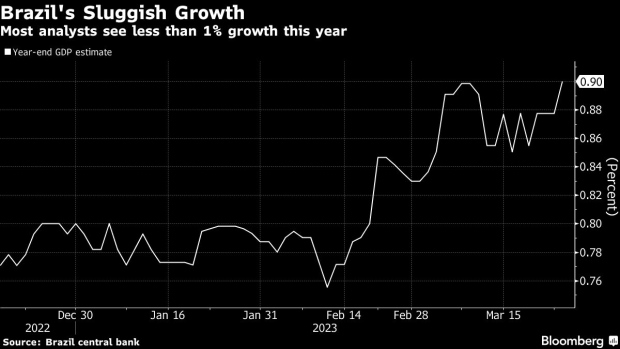

The bank forecasts that gross domestic product will expand 1.2% this year, more than the 1% growth it had estimated in December, according to its quarterly inflation report published on Thursday. Policymakers see agriculture and livestock as the main drivers of economic activity. Analysts surveyed by the monetary authority, meanwhile, see GDP rising 0.9% in 2023 and 1.4% in 2024.

“Activity in 2022 exceeded initial expectations, but with a slowdown trajectory throughout the year, corroborating the scenario of deceleration expected,” policymakers wrote in the report. They also pointed to an “evident” slowdown in the labor market.

Latin America’s largest economy shrank in the final months of 2022 on the back of weaker agriculture production. Months of high interest rates, which currently sit at 13.75%, are also hurting activity and causing worrying signs in credit flows, retail sales and industrial production. Most analysts see sluggish growth on the horizon, as the positive impacts of multi-billion dollar inflows from exports boosted by Russia’s invasion of Ukraine fade away and overall activity returns to pre-pandemic levels.

What Bloomberg Economics Says

“Forecasts in the Brazilian central bank’s quarterly inflation report back the hawkish message in the minutes and statement from the March meeting. There were no special studies in the report substantiating policymakers’ rationale on neutral rates or monetary policy transmission. That weakens the BCB’s message, in our view, especially as the monetary authority is facing strong criticism on its rate policy.”

— Adriana Dupita, Brazil, Argentina economist

Click here to read the full report.

Read More: Brazilian Companies See Credit Flows, New Loans Slowing Down

Further evidencing the slowdown, Brazil’s industrial output fell 0.3% in January from the month prior, in line with the median estimate from analysts in a Bloomberg survey. From the prior year, industry grew just 0.3%, the national statistics institute said on Thursday.

Credit Takes a Hit

Central bankers revised down their estimate for outstanding loans after a “negative surprise” on their pace of growth late last year. They now expect such loans to expand 7.6% this year, down from a previous 8.3% forecast, and see higher default rates among individuals. Companies, they added, will face higher risk aversion when seeking financing due to “specific events related to big businesses.”

Retailer Americanas SA collapsed early this year after unveiling 20 billion reais ($3.9 billion) in “accounting inconsistencies.”

President Luiz Inacio Lula da Silva has publicly bashed current monetary policy, which he considers the main obstacle to economic growth and his ambitious agenda. But central bankers led by Roberto Campos Neto see inflation and core measures that strip out the most volatile items, like food and energy, still rising. Most analysts expect consumer prices to remain above the monetary authority’s goal all through 2025.

Read More: Faltering Economy Endangers Lula’s ‘Barbecue and Beer’ Promise

Policymakers see a slowdown in activity consistent with their tightening cycle, which ended last September and lifted borrowing costs from 2%, a record low. Credit flows are decelerating at the margin and the labor market is moderating with “relative stability,” they wrote in the minutes to their March 21-22 rate decision.

--With assistance from Andrew Rosati.

(Updates with more details from report and industry data beginning in fifth paragraph.)

©2023 Bloomberg L.P.