Aug 11, 2022

Brazil's Hedge Funds Switch Tactics on End of Bold Rate Hike Cycle

, Bloomberg News

(Bloomberg) -- After profiting from one of the world’s most aggressive monetary tightening cycles, some Brazilian money managers are switching tack and starting to bet on the opposite trade.

SPX Capital, whose Raptor fund is beating 99% of peers this year, and Ibiuna Investimentos, which manages more than 30 billion reais ($5.9 billion), have built positions that benefit from falling rates in Latin America’s largest economy. Genoa Capital, a fund launched in 2020 by Itau Unibanco Holding SA asset-management unit veterans, scrapped payer positions -- which gain from rising rates -- last month.

“We’re flirting with receiving positions in emerging economies,” said Rodrigo Azevedo, founding partner at Ibiuna who was the director of monetary policy at the nation’s central bank between 2004 and 2007. Inflation in Brazil has started to turn, but the question is how fast this move will be, Azevedo said at an event earlier this month.

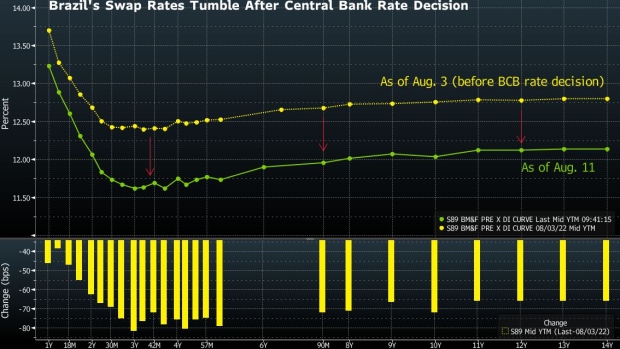

The shift comes as policy makers signaled last week the 17-month tightening cycle that took the country’s benchmark interest rate to 13.75% from 2% is nearing an end as inflation peaks. The dismantling of bets on higher rates has prompted a slump in local swap rates, with contracts due January 2025 falling 66 basis points over the past week. The bet on falling rates got an extra boost after US inflation slowed more than forecast on Wednesday, triggering a rally in emerging-market assets.

While rates and inflation may have peaked, fiscal uncertainties remain high and investors are bracing for October presidential elections. Former President Luiz Inacio Lula da Silva, who leads polls, signaled he’ll boost public expenditure if he returns to power, while incumbent Jair Bolsonaro has recently embarked on a spending spree to help offset the impact of inflation and boost his popularity.

Brazilian hedge funds gained from wagers in rising local rates last year and gradually shifted their bets to developed nations -- including the US. That has helped send returns jumping, with the Anbima Hedge Funds Index climbing 8.3% in the first six months of the year -- the strongest first-half since 2016.

Here’s what some of the main Brazil hedge funds said in their July monthly letters:

Absolute

Fund resumed bets on higher US rates and marginally boosted its short position in US stocks. Locally, it scrapped bets on higher rates. Brazil’s economic activity should prove resilient amid the government’s fiscal package.

- Absolute Vertex FIC -0.42% in July; benchmark CDI rate +1.03%

- Link to letter

Adam Capital

Uncertainties remain elevated despite a favorable environment for risk assets. Odds of a normalization in global asset prices amid the economic slowdown are now higher.

- Adam Macro II FIC +2.11% in July

- Link to letter

Bahia Asset Management

Brazilian assets got a boost from the global risk-on mood and the rebound in commodities last month. Fund is betting on higher rates in Canada.

- Bahia AM Marau FIC -1.04% in July

- Link to letter

Genoa Capital

Fund closed positions that stood to gain from rising Brazilian rates, scrapped a bearish bet on the real and currently has a net long position in local stocks.

- Genoa Capital Radar FIC FIM +1.18% in July

- Link to letter

Ibiuna Investimentos

Fund trimmed bets on higher rates in G10 economies, while having a low exposure to FX markets.

- Ibiuna Hedge STH FIC -2.06%

- Link to letter

Kapitalo Investimentos

Fund is short Brazilian inflation breakevens and trimmed its long position in domestic stocks.

- Kapitalo Kappa FIN FI +2.20%

- Link to letter

Legacy Capital

Fund expects Brazil’s gross domestic product to grow 2.3% this year. Current environment favors bets on the steepening of rate curves, short positions in equity markets and bearish bets on the US dollar and the euro against other currencies.

- Legacy Capital FIC -0.26%

- Link to letter

SPX Capital

Fund scrapped its bullish bet on Chinese stocks, and still has short positions in US, Europe and Brazil stocks.

- SPX Nimitz Feeder FIC -1.19%

- Link to letter

Verde Asset Management

A scenario where Bolsonaro narrows his gap with Lula “is quite likely” over the next month. Verde fund trimmed its position in global equities following the sharp rally in US stocks last month, while maintaining its exposure to Brazilian names. Fund closed a long position in the Brazilian real that had been opened using options.

- Verde FIC FIM +1.54%

- Link to letter

©2022 Bloomberg L.P.