Dec 7, 2018

Brazil's November Deflation Exceeds All Economist Forecasts

, Bloomberg News

(Bloomberg) -- Brazil’s consumer prices fell more than all forecasts in November, supporting the view that the central bank will be in no rush to raise interest rates in 2019.

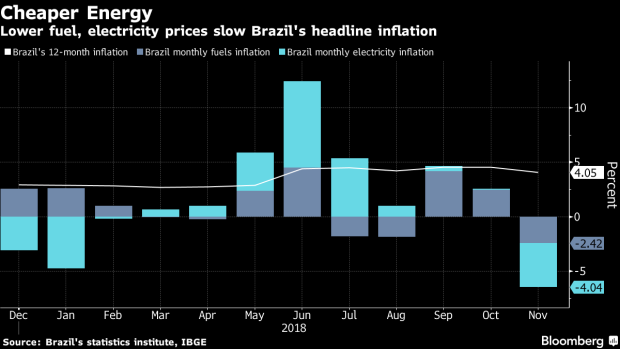

Consumer prices measured by the benchmark IPCA index fell 0.21 percent in November, the biggest deflation in 1-1/2 years, after a 0.45 percent increase in October. Economists expected a 0.09 percent decline. In the 12 months through November, inflation slowed to 4.05 percent from 4.56 percent the prior month, the national statistics agency reported Friday.

Key Insights

- Disinflation is expected to continue, with economists forecasting the IPCA will finish 2018 more than 60 basis points below the 4.5 percent target

- Slow inflation has allowed Brazil’s central bank to keep its benchmark rate at a record low, and also prompted traders to pare bets on 2019 tightening

- Central bank chief Ilan Goldfajn will step down from the position next year and President-elect Jair Bolsonaro has nominated Roberto Campos Neto as his replacement

Markets

- Swap rates on the contract maturing in January 2021, a barometer of future interest-rate moves, fell 8 basis points to 7.83 percent in early-morning trading.

Get More

- Electricity prices fell 4.04 percent, and its decline was equal to three quarters of the month’s deflation

- Fuel prices fell 2.42 percent, helping bring transport prices down 0.74 percent

- Food and beverage prices in the IPCA index increased 0.39 percent in November after climbing 0.59 percent in October

To contact the reporter on this story: David Biller in Rio de Janeiro at dbiller1@bloomberg.net

To contact the editors responsible for this story: Vivianne Rodrigues at vrodrigues3@bloomberg.net, Walter Brandimarte

©2018 Bloomberg L.P.