Dec 9, 2021

Brazil Says World’s Boldest Rate-Hiking Cycle Is Far From Over

, Bloomberg News

(Bloomberg) -- Brazil’s central bank delivered its second straight interest rate hike of 150 basis points and pledged that the world’s most aggressive tightening cycle won’t end until rising inflation estimates return to target.

The bank on Wednesday lifted the Selic to 9.25% and anticipated another hike of the same size in February, leading economists to estimate the rate may reach as much as 12% early next year. Policy makers have now raised borrowing costs by 725 basis since March, the most among major global economies.

“It is appropriate to advance the process of monetary tightening significantly into the restrictive territory,” the central bank wrote in a statement accompanying its decision, citing an increase in its own inflation projections and risks of higher market forecasts in the long-term. “The committee will persist in its strategy until the disinflation process and the expectation anchoring around its targets consolidate.”

Policy makers led by Roberto Campos Neto are struggling to control inflation expectations that have steadily deteriorated even as Latin America’s largest economy slips into recession and unemployment remains above 12%. Price pressures are lasting longer than forecast not only due to global issues such as costlier fuel and food, but also concerns about rising government spending ahead of the 2022 presidential election.

Read More: Brazil Slips Into Recession as Post-Pandemic Recovery Cut Short

What Bloomberg Economics Says

“The reference to rising inflation expectations and the explicit mention of monetary policy advancing ‘significantly’ into tight territory may lead markets to price in a higher terminal rate for this cycle than currently embedded in the yield curve. The prospect of higher rates may also support the currency.”

--Adriana Dupita, Latin America economist

Click here to read the full report

While inflation has become a global issue in the aftermath of the pandemic, it is hitting Latin America harder. Peru, Chile, Mexico and Colombia are all expected to raise borrowing costs in the next few days to cool down increases in the cost of living.

Yet prices are rising faster in Brazil than in most of its neighbors: annual inflation likely reached 10.9% in November, the most since 2003, according to the median estimate in a Bloomberg survey of economists. The national statistics institute will publish the figures on Friday.

Read More: Fish Heads Replace Steak at Dinner in Stagflation-Ravaged Brazil

“The battle against inflation and drifting expectations is far from over and the central bank is well aware of the magnitude of the challenge,” said Alberto Ramos, chief Latin America economist at Goldman Sachs Group Inc. “Unfortunately, in this quest the bank cannot count on much support from fiscal policy.”

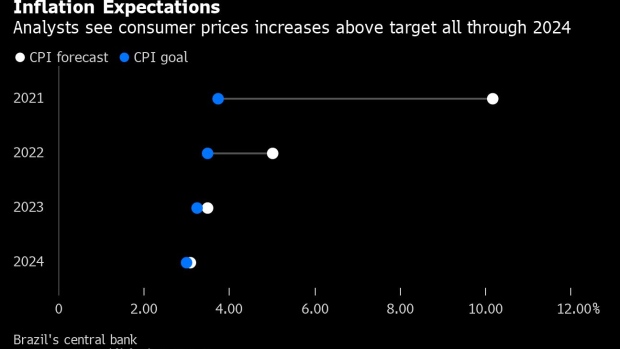

Brazil’s central bank targets inflation at 3.75% this year and 3.5% in 2022, with a tolerance range of 1.5 percentage points.

Hawkish Statement

The central bank doubled down on plans for tighter monetary policy despite mounting risks to growth. Both retail sales and industrial output dropped in October in a fresh sign of malaise after the economy fell into recession in the third quarter.

Recent economic indicators have been moderately below expectations, policy makers wrote in the statement. Globally, the possibility of another Covid-19 wave and the emergence of the Omicron variant add uncertainty to the recovery of advanced economies, they added.

Analysts surveyed by the monetary authority have cut their 2022 growth forecasts by nine straight weeks, to 0.51%. Given the dimming outlook, the central bank surprised by reinforcing its commitment to anchoring inflation expectations, according to Brendan McKenna, a strategist at Wells Fargo in New York.

“It’s one of the most hawkish statements we’ve seen this year,” McKenna said, noting that it will help boost the real. “I was looking for a slowdown in the pace of tightening, but given today’s tone I will adjust my Selic rate forecast higher for February.”

Read More: BCB Plan Provides Fuel for Swap Rates to Rebound: Inside Brazil

Going forward, there’s no shortage of potential inflation drivers. Globally, there’s the possibility that the U.S. Federal Reserve may raise rates sooner than expected. Likewise, the spread of the Omicron strain of Covid-19 raises prospects of new lockdowns which may revive supply shocks.

Domestically, President Jair Bolsonaro is planning on increasing aid to the poor ahead of next year’s vote. In the statement, policy makers warned that additional fiscal stimulus may boost aggregate demand and pressure Brazil’s risk premium.

“It was a more hawkish statement than we expected,” said Tatiana Nogueira, economist at XP Inc. “They will keep raising rates to a level significantly above neutral.”

(Recasts story, adds details from bank statement starting in second paragraph)

©2021 Bloomberg L.P.