Oct 27, 2021

Brazil Tightens Most in Years, With 150 Points Now and December

, Bloomberg News

(Bloomberg) -- Brazil’s central bank delivered its biggest interest rate increase in almost two decades and pledged another equally large move for December, as it fights alone against deteriorating inflation expectations and growing fiscal concerns.

The bank lifted the Selic by 150 basis points to 7.75% on Wednesday, as estimated by most economists surveyed by Bloomberg, and said another hike of the same magnitude would be fitting at its final meeting of the year.

“Given the deterioration of the balance of risks and the increase in its inflation projections, this pace is the most appropriate to guarantee inflation convergence to the targets at the relevant horizon,” policy makers wrote in a statement accompanying their decision.

Policy makers led by Roberto Campos Neto have been the most hawkish in the world this year, raising the benchmark rate by 575 basis points since March. They are speeding up their monetary tightening campaign after President Jair Bolsonaro proposed to bypass a key austerity rule to boost handouts to the poor.

Read More: Central Banker Stands Alone With Brazil’s Credibility Crumbling

Yet there’s a risk that they will need to turn even more hawkish to prove their inflation-fighting credentials.

“Today’s move is a decisive step in the right direction and much needed amidst the erosion of the fiscal anchor,” said Alberto Ramos, chief Latin America economist at Goldman Sachs Group Inc. “But unfortunatelly more is likely needed. Get ready for a double-digit Selic in 2022.”

What Bloomberg Economics Says

“Brazil’s central bank accelerated the pace of rate hikes, pledged another large increase in December and indicated that monetary policy will end the cycle tighter than previously anticipated. But the key questions -- what the BCB thinks of proposed fiscal changes and what they mean for neutral rates -- remain unanswered.”

-- Adriana Dupita, Latin America economist

Click here to read the full report.

Such a move is likely to have an impact in sectors that greatly benefited from a recent period of low interest rates, including real estate and the equity market, on top of boosting Brazil’s debt service burden. It’s also likely to slow down activity further at a time some economists warn about the growing risk of recession next year.

It’s not guaranteed to boost the real, however. The currency weakened more than 3% last week, adding pressure on inflation, as investors digested the proposed changes to the so-called spending cap -- a rule that limits growth of the federal budget to the previous year’s inflation rate. Crucial for its performance will be whether lawmakers decide to increase the amount of public expenditures that may be exempt from the cap.

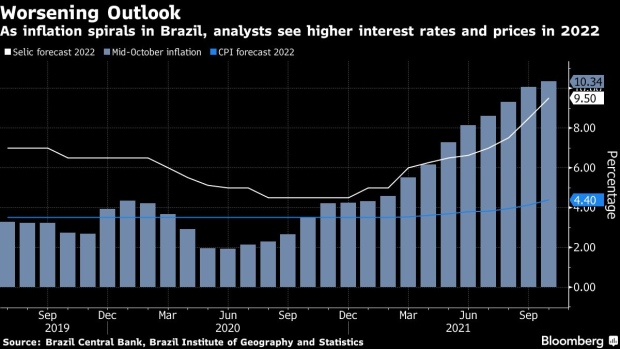

Consumer prices rose 1.2% in mid-October, more than all forecasts in a Bloomberg survey and the highest for the month since 1995. Annual inflation surged to 10.34%, according to government data published on Tuesday.

Central bankers had previously expected inflation to peak in September. Most analysts see consumer prices rising 8.96% this year and 4.4% in 2022, above the respective goals of 3.75% and 3.5%. Expectations for 2023 and 2024 also surpassed target this week.

The last time policy makers delivered an increase of more than 100 basis points to the Selic was in late 2002, when markets panicked as Luiz Inacio Lula da Silva was about to assume the presidency.

(Updates with economist comment in sixth paragraph.)

©2021 Bloomberg L.P.