Jan 17, 2018

Brian Madden's Top Picks: January 17, 2018

BNN Bloomberg

Brian Madden, senior vice president and portfolio manager at Goodreid Investment Counsel

FOCUS: Canadian equities

_______________________________________________________________

MARKET OUTLOOK

2017 fades into the history books as another strong year for investors, marking the ninth consecutive year of gains for the U.S. equity markets and the seventh year of gains since the 2008 financial crisis for the Canadian market. The S&P 500 index earned a total return of 21.8 per cent in 2017 and the S&P/TSX Composite Index posted a 9.1 per cent total return. Accordingly, risk appetites are running hot. For instance, speculative and junior marijuana and blockchain stocks dominate the leaderboard on Canadian markets almost daily with frantic media hype and trading volumes suggestive of a typical holding period that spans just a few weeks — hardly the stuff of disciplined investment. Bitcoin, that most enigmatic of things (is it a currency? An asset? A commodity? The mother of all Ponzi schemes?) closed the year above US$14,000: 15 times the level where it began the year.

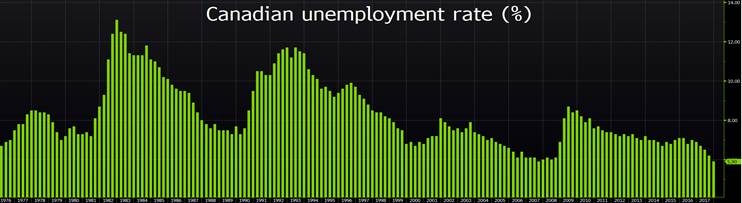

The implied volatility of U.S. stocks (the VIX, the barometer sometimes referred to as the “fear” gauge) has until recently been plunging to all-time lows below 10, and the S&P 500 index has posted an almost unprecedented string of 14 successive months of positive returns. Here in Canada, job creation has been nothing short of sensational, with a whopping 422,500 jobs created in 2017, such that the unemployment rate at 5.7 per cent is at the lowest level in recorded statistics, going all the way back to 1976.

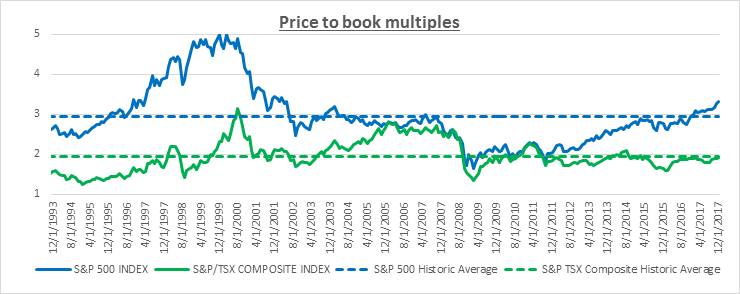

So, does all of this good news portend a bad ending? Of course not, and there’s no immutable law that says another good year can’t follow a long string of successful years. But it does call for caution, particularly since stock market valuations are at or above long term averages in both Canada and the United States — which is not in its own right either a necessary or a sufficient condition for a decline in stock prices, but in combination with other risk elements it could be problematic.

Trying to time markets is invariably a failed strategy. Goodreid’s tried and true approach has been simply to try to be better during good times and less bad during poor times. A cautious or more defensive stance must ensure that we don’t choke off opportunity. It should be viewed as a dial with varying degrees of risk exposure as opposed to a switch, which has only two options: risk on or risk off. The tools at our disposal include the management of asset mix, our degree of exposure to different sectors and security selection. Past experience shows that most investors find their portfolios overexposed to stocks when market corrections inevitably occur. This happens for a couple of reasons. First, arithmetically, equity weightings naturally rise during strong markets and secondly, psychology leads investors to reward what has rewarded them and to eschew that which has disappointed them. Rebalancing to target asset weights is something that we do on an ongoing basis and will continue to do in 2018.

Many investors question the validity of bonds in portfolios at times like these, with interest rates near historic lows and rising. We too are mindful of the impact of low but rising interest rates on a bond portfolio, but history teaches us that bonds often “zig” when stocks “zag”…a truism that is easy to forget nine years into one of the strongest U.S. equity bull markets in history.

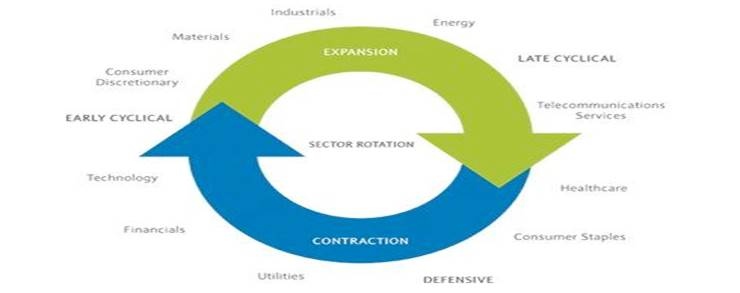

We also know that sectors react differently to the various stages of an economic cycle, as certain elements of the economy are more interest rate sensitive than others, while other sectors are more inflation, growth and capacity utilization sensitive. Thus it pays to be mindful of clues that the economy may be moving from recession to early expansion to middle expansion to late expansion and finally back into recession.

Economic cycles have been getting longer since about 1980, coinciding with the rapid rise of the service sector, and with the advent of business practices like just-in-time inventory management, and for various other reasons as well, but by no means has the business cycle been eradicated. Thus taking profits in fully valued defensive sectors for reinvestment into cyclical sectors as an expansion takes hold makes sense, just as taking profits in fully valued cyclicals for reinvestment in defensive sectors also makes sense as an expansion gets long in the tooth.

Finally, company specific attributes help shape performance during positive and negative times in the market. The time will come, perhaps in 2018, to position equity portfolios more defensively, reducing beta (or specific company volatility) and cyclicality. Characteristics like revenue visibility and stability, low operating leverage, formidable balance sheet & financial strength and consistency of growth take on added importance in a slowing economy. In a nutshell, the emphasis shifts towards companies where we have a high level of confidence in the company achieving financial forecasts and executing on its business plan and away from more rapid and dynamic, but also more erratic growth situations. We will be closely watching a number of indicators including the slope of the yield curve, employment growth, retail sales and purchasing manager indices as well as market breadth and other sentiment measures to guide us in making this pivot.

To be clear, this defensive game plan is not market timing, which we consider to be a fool’s errand. Rather this is strategic asset allocation and investment strategy in practice with a view to firstly, protecting capital and secondly, growing it responsibly amidst a potentially more challenging investment terrain.

TOP PICKS

SHOPIFY (SHOP.TO)

Shopify is Canada’s largest e-commerce enablement company, and is growing at a torrid pace with sales up 72% compared to the prior year in their latest quarter. Shopify, which went public in 2015 hit an important milestone in their latest quarter, reaching financial breakeven after years of heavy investment in their platform and capabilities. We are drawn to their comprehensive “retailer/e-tailer-in-a-box” open platform solutions for small and mid-sized businesses with functionality spanning sales promotion management, inventory management, shipping and order management, point-of-sale solutions/retail hardware, payments, and receivables financing. Shopify offers connectivity to all major sales channels and payment methodologies whether they are web-based (Amazon), mobile (Apple Pay), social media based (Facebook) or bricks and mortar. The company is investing back into enriching their user experience and their platform functionality, creating high switching costs via greater integration into all aspects of their clients’ businesses. This has been restraining short term profitability, but in our view is cementing loyalty which should lead to higher lifetime revenue and ultimately profit per client. Latest purchase Jan, 2018 at $141.73.

FRANCO-NEVADA (FNV.TO)

Franco-Nevada is a resource royalty and investment company whose management team and founders pioneered the resource royalty concept over thirty years ago. The business model affords shareholders exposure to commodity prices via a royalty payment for each ounce produced (primarily, gold, silver and other precious metals and to a lesser extent, oil and gas and other metals) but insulates them from the operating and capital cost overruns that are endemic to the mining industry. The business model also affords shareholders long term optionality on future discoveries on any of their royalty lands, across a portfolio of 339 royalties that is well diversified by commodity, by geography and by operator. Franco-Nevada has consistently outperformed its gold mining peer group, in eight of the last ten years since its initial public offering, on the strength of this superior business model. Latest purchase Jan, 2018 at $97.96.

BANK OF NOVA SCOTIA (BNS.TO)

Scotiabank is Canada’s second largest bank and is the nation’s most globally ambitious bank, with a long established footprint in Mexico, Latin America, the Caribbean and Asia. Scotiabank earns a 14.5% return on shareholder’s equity and has grown earnings per share at a 7% rate over the last five years, with commensurate increases in its dividend. The company has the largest exposure to fast growing and “underbanked” emerging markets among the big 6 banks, and further has internal efficiency and excess capital levers to pull in driving superior earnings growth over the next several years. The bank is deploying some of this capital and is further bolstering its footprint in Chile with the pending $2.9B acquisition of BBVA’s Chilean bank. Trading at 11.8x 2018 expected earnings, and yielding 3.9% Scotiabank is well poised to continue its consistent pattern of outperforming the TSX…a feat that it, along with other members of the Canadian banking oligopoly, has accomplished in 18 of the last 25 years. Latest purchase Jan, 2018 at $81.73.

| DISCLOSURE | PERSONAL | FAMILY | PORTFOLIO/FUND |

|---|---|---|---|

| SHOP | N | N | Y |

| FNV | N | N | Y |

| BNS | N | N | Y |

PAST PICKS: FEBRUARY 15, 2017

MAGNA INTERNATIONAL (MG.TO)

- Then: $59.14

- Now: $74.26

- Return: 25.56%

- Total return: 28.55%

SHOPIFY (SHOP.TO)

- Then: $79.22

- Now: $142.81

- Return: 80.27%

- Total return: 80.27%

GLUSKIN SHEFF + ASSOCIATES (GS.TO)

- Then: $18.13

- Now: $15.52

- Return: -14.40%

- Total return: -4.77%

TOTAL RETURN AVERAGE: 34.68%

| DISCLOSURE | PERSONAL | FAMILY | PORTFOLIO/FUND |

|---|---|---|---|

| MG | N | N | Y |

| SHOP | N | N | Y |

| GS | N | N | Y |

FUND PROFILE

Goodreid Balanced

Performance as of: December 31, 2017

Goodreid’s Balanced Approach allows investors to participate in the potential growth of equity holdings while mitigating risk through ownership of quality fixed income instruments.

1 Year: 10.5% fund, 6.1% index

3 Year: 7.5% fund, 4.7% index

5 Year: 10.5% fund, 7.1% index

*Index: Globe Canadian Equity Balanced Peer Index Average

**Income reinvested and net of fees

TOP HOLDINGS AND WEIGHTINGS

- Canadian equities: 33%

- U.S. equities: 40%

- Canadian fixed income: 17%

- Cash: 10%

WEBSITE: www.goodreid.com